Hello again, friends. I haven’t written a stock-specific thesis on this publication in over a year, but it’s time to mix things up again. Today, I’ll present evidence that Envovix, a California-based battery company with meager revenues, big promises, and an eye-watering $3 billion market capitalization is riding high on hype and little else.

https://twitter.com/ESGhound/status/1675591016097673217?s=20

Putting the content of a post that outlines a short-selling thesis behind a paywall isn’t really good for business or exposure… but I don’t want all my lovely subscribers to get the short end of the stick, so they’ll get an 18-hour jump on the report here, as well as a post tomorrow, breaking down how exactly I put this piece together.

You ready? Let’s go

Summary

Enovix Management has repeatedly misled customers about their manufacturing capabilities and volumes.

Last November, and just four days after the Bay Area Air Quality Management released records that revealed management was overstating production capabilities at their Fab-1 facility in California by ten times, management released guidance indicating that production at this facility would be significantly lower going forward.

PART 2 next week will discuss the Upcoming Malaysian production plant as well as some technical “concerns” experts have on Enovix.

Background

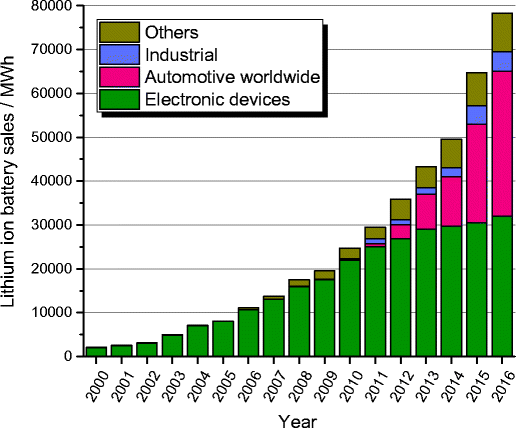

Enovix, headquartered in Fremont, California, was founded by three ex-IBM employees in 2007. They set out to make a better battery and their timing couldn’t have been better.

Between the company’s founding and today, global Lithium Ion battery production has increased by well over 30-fold. The explosion of power-hungry smartphones drove the first surge in production following the release of the iPhone in 2007. Demand for cells took off to new heights as EVs and stationary storage deployment became the hot new thing in subsequent years.

Enovix’s current pitch is a battery that uses silicon, instead of graphite, as the battery anode. The anode stores positively charged lithium ions in the battery’s charged state; as the battery is discharged during usage, the free lithium crosses back into the cathode (a lithium metal oxide).

Chemically, a silicon-based anode offers an attractive appeal. On a mass basis, silicon can accommodate several times more lithium ions in the charged state. This increases the mass efficiency of a battery. It is such an appealing concept that Panasonic, unquestionably the leader in global battery technology and manufacturing, announced its intention to develop a silicon anode battery back in 2009. As of today, Panasonic appears to have entirely abandoned the idea.

But why?

Well, the tricky part of silicon is that while its mass efficiency is clearly superior to the industry standard graphite, silicon has a bit of a volume problem. Silicon anodes can (and do) swell up to 300% in volume when fully saturated with lithium. Silicon also degrades upon repeated charging cycles. These two factors make silicon anode batteries highly dangerous as the physical and chemical fluctuations between charging states risk the battery suddenly discharging, which can result in catastrophic self-immolation.

ENVX claims to have solved this problem by tightly packing the battery components into a rigid rectangular steel casing. We’ll get more into this in later posts, but that’s the pitch. Small, energy-dense batteries using silicon anodes for things like laptops and portable devices where every gram of mass matters.

But despite being in business for 15 years, the company still has no meaningful revenue to speak of. They handed out samples of their “revolutionary” battery to prospective customers as early as 2018, yet no major buyer has shown up with an order.

Perhaps that’s why they jumped on the SPAC reverse merger craze of 2021 to go public. Sitting today at a $3 billion valuation, the company somehow avoided the great SPAC wipeout, though still 50% below their meme stonk highs of 2021.

ENVX Management Spent all of 2021 and 2022 Lying to Shareholders

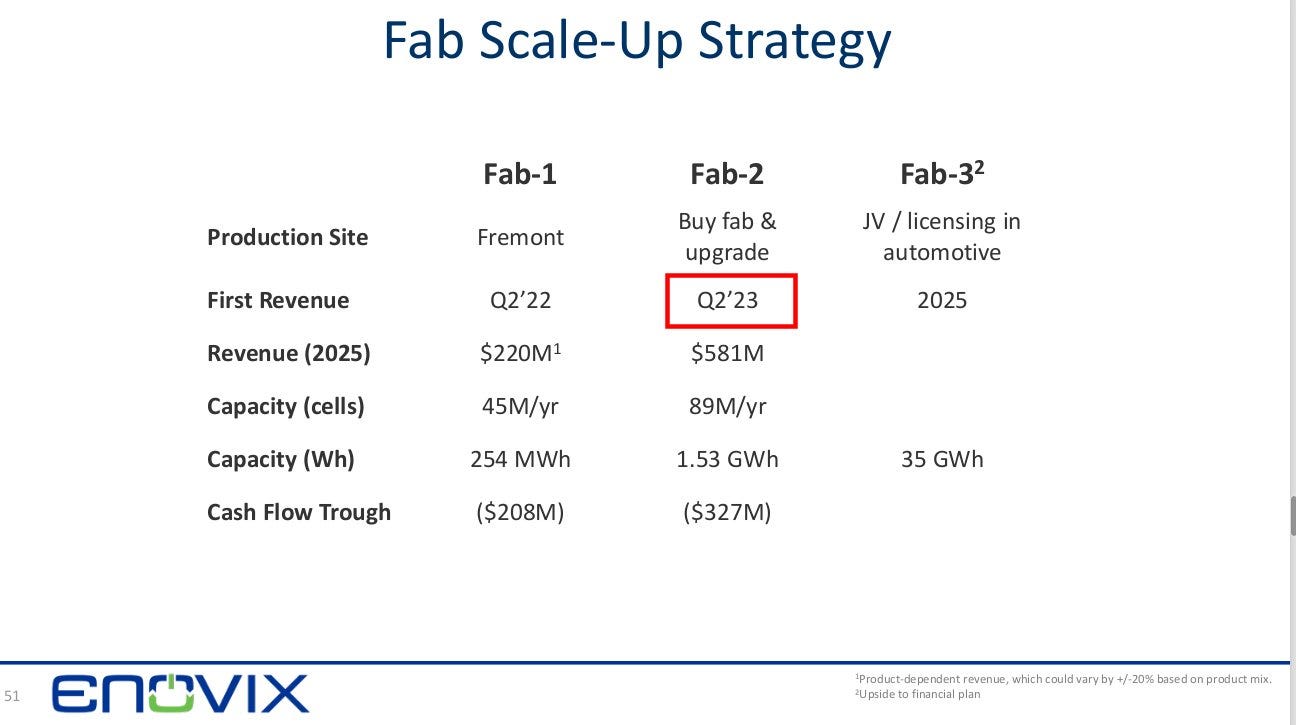

Nothing stated above is new information. But here’s where we get to the good stuff. Take a look at the “Fab Scale-Up Strategy slide:”

In the initial SPAC presentation in 2021, ENVX laid out their plans to start producing their battery at “Fab-1” in Fremont. With a capacity of 45 million units and a total capacity of 254 MWHr per year, that meant that the average cell would be in the 5.6 Wh range, or roughly a 60% Mix of the IoT/Wearable cell (1.17 Wh) product and a 40% in the industrial/Mobile cell range:

This guidance, Fab-1 capacity of 45 million units and $220 million in revenue, has never been officially walked back by the company. However, on November 1, 2022, the company dropped a bombshell on investors in the Q3 Earnings release:

“We expect Fab-1 improvement activities to extend into 2023, but at a slower rate given the decision to redirect resources to Gen2. Given this, we expect to exit 2023 at a run rate of under one million battery cells produced”

A downgrade of “45 million units annual capacity” to “one million in production of only our smallest battery” is quite an about-face. Fret not, though; the company has moved on to promising great things for Fab-2, to be located in Malaysia, in the very near future!

“But Eric!” I hear you cry. “Companies re-evaluate stuff all the time, simmer down, this is all about Fab-2 now.”

But, if we look at the timeline for how ENVX discusses production goals and accomplishments for their Fremont facility, what emerges is a very clear picture of dishonest management. This is the basis for a good short-selling opportunity. Management that repeatedly lies, obfuscates, and refuses to adequately address past falsehoods, preferring instead to move on to even bigger promises in the future, represents equity that should be avoided by investors.

I will be using the following sources:

Earnings Press Releases from the company

Investor presentations from the company

The company’s correspondence with air pollution and building permit regulators, accessed via public records requests by yours truly.

TIMELINE

In February of 2021, Enovix was acquired by SPAC vehicle Rodgers Silicon Valley Acquisition Corp. The Initial Investor Slide deck, including the “Fab Scale-Up Strategy” slide, was included as an exhibit to the SEC filing.

Feb 2021 Investor Presentation (From SPAC acquisition announcement):

Fab-1 to have capacity to support 45M units, 254 MWh and $220M in revenues across two manufacturing lines

May 2021 Investor Presentation:

Fab-1 to have capacity to support 45M units, 254 MWh and $220M in revenues across two manufacturing lines

Addition of the following slide (“Fab-1 Equipped NOW” Slide):

August 2021 - Q2 Letter to Shareholders:

“During the Quarter we were able to take receipt of the key equipment for our first production line. (sic) This required a heroic effort on the part of the team, including a crucial decision to charter an Anonov An-124, one of the world’s largest cargo planes, to fly over 60 tons of manufacturing equipment from Asia to San Francisco International Airport”

“These are important steps ahead of our expectation of beginning production in Q1 2022”

My commentary here is bewilderment. They told investors that Fab-1 was “equipped” THREE MONTHS before this letter celebrating they *received* equipment for production line one out of two on Fab1, overnight via cargo jet no less.

Bill of Lading and import data shows that they were receiving equipment throughout the quarter, with the largest piece of equipment (at 35,000 kilograms) arriving in July, which as you might note, is not in Q2, as stated in the investor letter.

November 2021 - Q3 Letter to Shareholders:

“Fab-1 was fully equipped during the quarter, and by September we were able to produce the first batteries from our first automated production line.”

“By the end of Q4 2021 we expect to send our first production samples to several customers for final manufacturing line qualification.”

From May 2021 to November 2021 the company narrative went from “Fab-1 Equipped, NOW” to “one half of Fab-1 equipped last month”

January 14, 2022 Permit Application to BAAQMD:

On January 14th of the following year, Enovix finally got around to submitting an air pollution permit application to the Bay Area Air Quality Management District.

This document, which I have uploaded here, is significant. First of all, Enovix was previously using an R&D and de minimus exemption under BAAQMD and California’s SEP under the Clear Air Act.

🚨It is here that the lie became a big one.

Submitting documentation to a State or Federal Agency requires certification as to the accuracy of the information submitted. This includes environmental permitting agencies. If the data they submit is fundamentally incompatible with what is conveyed to investors, you are either committing securities fraud under the Securities and Exchange Act OR are committing a felony under State and Federal laws regarding regulatory filings.

When seeking permit approval for production at scale, there are two things to consider:

Permitting must be complete PRIOR to construction. Since this is a minor source, permitting can be completed in 6 or so months, even in the hyper-regulated Bay Area.

Permitting must consider the Potential To Emit (PTE). Equipment is to be permitted at its maximum design capacity. It doesn’t matter if you intend to run it less often or at lower rates to decrease emissions, you must disclose the design of the unit. A peaking power plant, for example, that may only run for a few hundred hours per year must still submit a permit application that assumes it runs 24/7/365 at maximum load. Time limits and actual permitted emissions for intermittent operations are fleshed out in the permitting process.

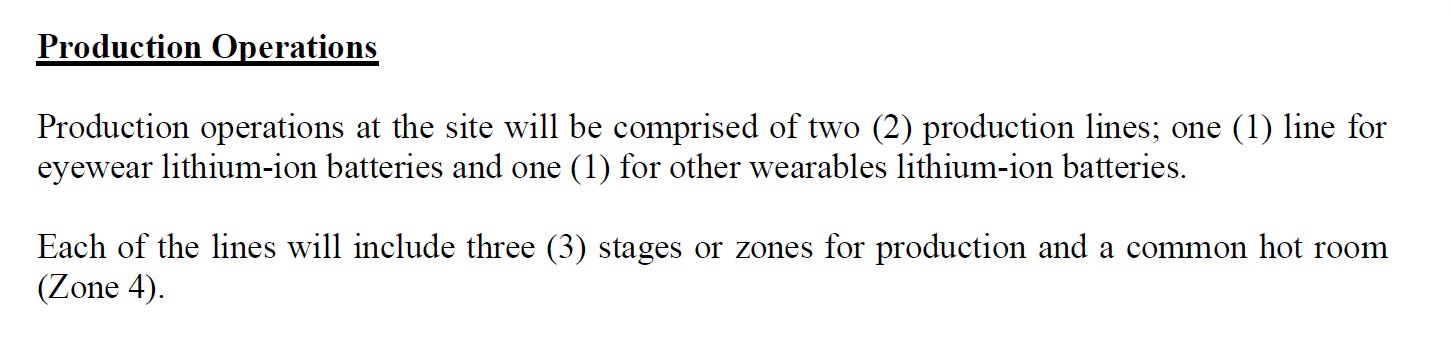

Now, on to the permit application. The document, submitted by Enovix, states that the facility will include 2 production lines. One for wearables and one for eyewear wearables.

Keep in mind, these are the smallest of the Enovix batteries, listed on their website at 1.17 Wh.

Sometimes, when dealing with Air Permits, you have to back-calculate production from emissions as the company will obfuscate actual unit production and/or claim it as a Redacted Trade Secret. Not here, though!

In January of 2022, Enovix told the air pollution agency they were installing two production lines for wearables with identical alumina application volumes. The total production rate of the two lines? 1,200 Units per hour.

Let’s do some math:

2 lines * 1200 units * 8760 hours/year = 21 million unitsUsing the 1.17 Wh value from the website for wearable batteries, that is a total cell output of 24 MWh.

Last time I checked, 21 million Units is 53% lower than the official guidance of 45 million units and 24 MWh is 91% lower than the guidance of 254 MWh. Yikes!

But folks, it gets even better! The actual requested capacity is actually at least 50% lower because the electrolyte machines they want to install is only rated at 600 units per hour:

Based on the permitting documents, Enovix overstated their design capacity by FOUR times on a Unit basis and TWENTY times on an MWh basis. Double Yikes!

🚨Note to reader, I will break down the nuts and bolts of using air-permitting documents in a companion post to be released later this week!

March 2022 - Q4 Shareholder Letter:

“In 2022, we plan to incrementally scale up output from Fremont line 1 to produce batteries for the wearables market while bringing up line 2 in Fremont to make larger cells for customer qualification in the mobile communications and laptop markets.”

By this point, Management’s commentary on production is pretty sparse and generic. Keep in mind they have *still* not walked back the guidance (45M Units, 254 MWh, $220M sales) for Fab-1.

March 16-18, 2022 - BAAQMD Internal Correspondence

Two months after Enovix submitted their Air Permit application, BAAQMD (a government agency) pondered internally why they hadn’t heard back from the applicant.

The application was… not very good apparently?

I don’t have much commentary except to remind you that ENVX is a 3 billion dollar stock without much apparent urgency to get their equipment authorized.

May 2022 Investor Presentation:

This is the first company presentation still posted on their website which has removed the “Fab Scale Up Strategy Slide” (up until now, a fixture)

In its place is the new “Scoreboard” goal of $1 billion revenue of capacity (across all facilities)

The important commentary here is that as Enovix approaches REAL, WE SWEAR IT’S COMING ANY DAY NOW operations, the projections in production volumes and sales have faded away. This is the opposite of how honest and maturely run businesses operate. As the rubber hits the road, management should be more confident in predictions, not obfuscate and memory-hole past tall tales.

May 2022 - Q1 Shareholder Letter:

Let’s take a step back. From concrete actionable figures and projections at the time ENVX was acquired to May 2022, fourteen months later:

“With production underway, our focus in Fab-1 is on increasing volumes and yields. The large majority of the process steps that make up Fab1 operate today at very high yields. A small number are yielding below 95%, and we have a documented plan to drive these to their targeted yields. Delivering to plan is a journey of many incremental improvements that our operations team undertakes daily. These learnings have given us confidence to move forward with purchases for Fab-2.”

Management commentary on production at this point has devolved into a fractal, a meaningless word soup; none of the words strung together here mean anything. This is gobbledygook of the highest order, completely devoid of meaning or actionable information.

“Many of these volumes have high yield, some are below 95%, a small number, mind you; these learnings are a plan, which is also a journey.” It’s as if Thomas Pynchon ate 40 tabs of LSD, hit himself on the head with a hammer, and spent a week reading industry manuals on battery-making machines. Utterly nonsensical garbage.

August 2022 - Q2 Shareholder Letter:

At this point, ENVX management is avoiding any predictions on Fab-1. They have moved on to Fab-2 promises:

“During the second quarter, we furthered the design of our Gen2 manufacturing equipment with our suppliers but did not complete ordering. This is due to the incorporation of the latest learning from Fab-1 and to a lesser extent, the incorporation of our BrakeFlow technology into the equipment.

We view our Gen2 line as a significant inflection in our ability to scale as major elements of this manufacturing line are designed to occupy half the footprint of Gen1 while increasing output significantly.”

Enovix has apparently sold some cells from Fab-1 though!

Service revenue for the second quarter included $5.0 million from a single customer based on the shipment of commercial cellsfrom Fab-1 and our completion of various milestones of a product development program that included the design, development,and shipment of custom validation cells.

Overall, we shipped Fab-1 cells to 10 OEMs and four distributors globally in the quarter

October 26, 2022 - BAAQMD Fulfills Records Request to Me

I started looking at ENVX in October of last year. After going through the financials and production promises, I found the application and facility number for Enovix and submitted a public records request to BAAQMD. The documents sent are linked here and were discussed above.

You should note a few things. First: the production facility permit referenced elsewhere in this report is application 657497. The other application (638717) is for a diesel emergency generator. The production and battery line permit applications are still active as of the 26th of October, nine months after submittal, meaning they have yet to be approved. Nine months for a minor source permit issuance is, even for a government agency as deliberate as BAAQMD, a long time. The agency’s internal metrics show complete permit applications for minor sources have an average processing time of 60-90 days from application to approval.

I made the request on October 4th, 2022. California’s Open Records Act requires initial disclosure of the status of your records request within 10 calendar days. I had not heard back as of October 17th, so I called the agency. At this point, they informed me there was an internal legal review underway.

November 2022 - Q3 Shareholder Letter:

Four days after documents from my request was received, Enovix reported results and significantly downplayed production output from the Fremont facility:

“We expect Fab-1 improvement activities to extend into 2023, but at a slower rate given the decision to redirect resources to Gen2. Given this, we expect to exit 2023 at a run rate of under one million battery cells produced”

One million units from a facility that is still officially guided as having a 45 million unit run rate is… not amazing, folks! Plus: ENVX management still has not updated the actual capacity of the facility. The “Fab Scale-Up Strategy slide” guidance is still an endpoint for Fab-1. Management appears to be trying to thread the needle; downplay near-term production outputs from the facility without admitting that production from Fab-1 has been overstated for years.

Anyways, it’s probably a good time to point out the following subsequent departures from the company:

December 23, 2022 - CEO and President Harrold Rust Submits his resignation

January 17, 2023 - Board Member John D. McCranie Submits his resignation

January 17, 2023 - Chief Technology Officer Ashok Lahiri Submits his resignation

June 29, 2023 - Chief Financial Officer Steffen Pietzke Submits his resignation

Lying Liars Don’t Just Lie Once

The series of events that I outlined above can be characterized as nothing short of a deliberate lie. A series of lies, really. The company has known for years that its production projections were wrong. They submitted data to a government agency that directly contradicts what they told investors.

I intended this report to be a one and done, but there are more exciting records to go through! Next time, in part two, we discuss the fancy new Fab-2. In the meantime, I’ll leave you with this utterly insane announcement from the same November 2022 Shareholder Letter

“One of our key focus areas for improving throughput and productivity in Gen2 is upgrading the lasers we use to pattern our electrodes and weld certain elements of the battery together. We have recently added photonics talent, and today we are announcing a non-binding MOU for a collaboration with IPG Photonics Corporation (NASDAQ: IPGP), the leader in high-powerfiber laser technology to develop cutting edge, next-generation laser tooling and methods to optimize cell manufacturingprocesses. Our alliance with IPG provides ongoing access to the most advanced laser technologies and has already resulted inour Gen2 lasers having 5x the power of our current Gen1 lasers, far ahead of our original scale-up plan.”

And also a meme:

Until next time….

Disclosure: This report is the sole work of me, Eric Roesch. I was not paid or commissioned to write it. However, as an independent contractor, I currently provide research and advisory services to financial firms, funds, startups and companies, public and private alike. As such, assume I am short shares of ENVX and stand to make money in the event this equity decreases in value.