Alright, friends, I hope you had a fantastic Thanksgiving Holiday. I’ve finally got a system down (and the available resources) to blast out a weekly newsletter to your mailbox. Expect 1-2 news items and a NEW feature: regulatory updates taken from state and federal rulemaking sessions that include industry-specific factors as well as market-relevant changes (as I see them). This is part of a new database I am working on and should improve over time.

Okay, on to content:

How Thanksgiving led to a Deadly Refinery Explosion

When people think about refinery explosions, chemical releases, and other industrial disasters like oil spills and derailments, they usually imagine failed equipment due to poor repair. Or perhaps shoddy construction. Bad design and lack of regulation often come to mind as well.

For those of you who didn’t get a chance to watch the Aaron Sorkin experience that was HBO’s The Newsroom: you didn’t miss much. I watched a bit of the first season because Jeff Daniels is the best. I stopped watching because Aaron Sorkin is the worst. Newsroom-era Sorkin was at his post-West Wing peak, with his brand of hackneyed plot devices and self-congratulatory monologue directed straight at the camera, reaching a point of perpetual self-parody.

The pilot episode of The Newsroom had TV anchor Will McEvoy (Daniels) and his news crew expertly deduce several root causes of the 2010 Deepwater Horizon spill on the same day as the explosion and spill, with the brave TV Anchor being able to report on numerous failures that took years to unravel in the real world. The episode peaked near the end with Daniels grilling a hapless BP spokesperson on the Nightly Newscast:

McAvoy: Your company was hired to provide Zoneseal 2000 and SCR-100, a synthetic, cement-like substance meant to seal off the well–Yes or no?

BP Spokesman:Yes, we were, but now you’re saying–

McAvoy: That’s all I was saying. Now I’m asking if your company did tests on the substance before installing it at the base of Deepwater Horizon.

This was a moment of peak Sorkinsonism (Sorkinry?) and I distinctly remember loudly guffawing at the fictional recreation of the very real events that took place. McAvoy, on live TV, identifies numerous failures, from inspections, technical issues and regulatory lobbying, and confidently slays those at fault on camera. That in Sorkin’s world, the tidy black-and-white version of reality where high-minded liberal solutions to society’s greatest issues are easy and obvious, such a revelation could be gleaned after only a few hours of reporting is, of course, silly and trite on its face.

“Why are we drilling three miles underwater when we don’t have the technology to fix the world’s most predictable emergency?” McAvoy cries out in exasperation.

Sorkin’s view, one of technical and regulatory failures, does contain many truths. It’s also shared by much of the broad public. But it’s one of simple causes and simple solutions, with greed as the sole motivator. In reality, the Deepwater Horizon failure was complex and a result of multi-faceted failures, oversights, and bad luck. But for Sorkin, the solutions imagined are always technical, the result of a poorly tuned machine we can tweak.

Sometimes, we forget to think about how people act and how external events, including the timing of Holidays, can help create disaster.

On Tuesday morning, November 24th, 1998, a massive thunderstorm swept through the Seattle Metro Area. The Equion Puget Sound Refinery lost power due to high winds and lightning strikes. This 145,000-barrel-per-day plant, run by a Joint Venture between Shell, Saudi Aramco, Texaco and Motiva, was one of largest in the Pacific Northwest.

Downtime at a refinery is measured in minutes, as supply chain and operational costs start to pile up immediately. This sort of unexpected shutdown is expected and planned for. But starting a plant back up after an outage is one of the most dangerous parts of running such an operation. Oily, explosive chemicals are half-processed and sitting in process units. The loss of all utilities meant that the heaters and compressed nitrogen that kept the process running and inert had stopped. Vapors would be building where they shouldn’t and chunky, thick oil by-products would start gumming up valves, pipes, and filters as they coagulated and hardened.

By the next day, Wednesday 25th, plant utilities were mostly back online, but there was an issue with the Drum on the facility Coking Plant. Coking is a process of heating a heavy oil fraction at a refinery, with the longest hydrocarbon chains and other chemical contaminants coming out of the bottom of the process as a “Coke Slag,” a solid, coal-like by-product used for power generation and in steelmaking.

The sudden outage had caused the solids in the coke drums to start congealing and hardening; the process, which is central to this refinery’s operations, was blocked. The facility had some experience in dealing with similar incidents but ultimately, they had no way of knowing what the blockage would look like.

Management decided on directly opening up the Coke Drum, forgoing a proposed water flush procedure that had been used before but was ultimately decided against.

This proved to be a deadly mistake. Past Coke Drums blockages had involved a “tar ball” that would flow fairly freely once piping had been removed. This time, however, the blockage was a “huge mass of hot, partially coked residuum.” It wasn’t semi-liquid like the past tar balls, but it was solid and had trapped explosive hydrocarbon gasses in the drum.

After opening up the Coke Drum, a massive vapor cloud burped from the unit and was nearly immediately ignited in the presence of oxygen. Six workers died from the explosion, and a fire raged for hours afterward.

In retrospect, opening the vessel without assuring it was inert or water-quenched was a tragic and quite foolish mistake. A tragedy born out of human decision-making.

Management greed and incompetence were at play here, undoubtedly. Some operators stated that they told management that the process vessel should be filled with water before doing anything, as revealed in the US Chemical Safety Board Investigation. There was also no set procedure for this rare but foreseeable activity. A better design of the Coking System could have likely prevented the blockage from occurring.

But that Wednesday was the day before Thanksgiving. The refinery’s technical support at Shell’s Westhollow Technology Center, was not contacted for advice on how to manage this unusual situation. Many support SMEs were checked out for the week. Interviews indicated that there was an unspoken thought that no one wanted to bother technical staff on a week that is reserved for spending time with family. Operators themselves admitted that Thanksgiving being right around the corner actively hindered their own usually meticulous decision-making abilities.

This is not to let Refinery Management off the hook. This incident was preventable. But in a world where we only think of failures as deliberate; of lobbying, regulation, maintenance, and operating industry as a big machine that can be adjusted with just a little more neoliberal wonkery, we have to remember that the people involved aren’t robots. Greed can be a killer, but so can human nature.

Circling back to The Newsroom, the most infuriating part of Sorkin’s whole schtick is that, in his world, problems are solved with just a good speech by a great man. He views human nature as a spark to ignite change for good in the world without understanding that our very nature, the good, the bad, and all the shades of grey in between, dictate how everything happens.

Affecting change requires a constant push and pull between humans and how we work and live and think. It’s not just a matter of flipping a switch. We also have to remember that sometimes dreaming of turkey and football, unequivocally good things to feel, can contribute to our own demise.

As I started working on this post, I saw a rail incident on Thanksgiving in Kentucky. These incidents are relatively common, but when they occur around holidays, I always wonder how much could be the result of complacency:

Nov 23 (Reuters) - A train derailment that spilled molten sulfur in a remote area of eastern Kentucky on the eve of Thanksgiving disrupted holiday plans for local residents on Thursday, some of whom were forced to evacuate after the incident.

The derailment occurred north of Livingston, a town of about 200 people, and involved 16 cars, including two carrying molten sulfur that spilled some of their load.

Railroad operator CSX (CSX.O) said in a statement that the fire from the spilled sulfur had been extinguished.

Wise Words & Marketing

I’d like to imagine that on day one of every single Freshmen level marketing course on the planet, the first slide shown by the professor just has this Michael Jordan quote in size 72 font:

Republicans buy sneakers, too

MJ is not only one of the greatest professional athletes of all time, but he also invented modern corporate/personal hybrid branding. While the GOAT may have walked back one of his most famous quips as a “joke” in later years, it remains a succinct, sharp and insightful marketing truism. If you want to sell a global product to as many people as possible, you must remain as politically neutral as possible.

Elon Musk, who once again gets an appearance in this publication as a walking Governance nightmare, has continued to quadruple down on displaying just how quickly his rapidly melting brain is turning into a pool of reactionary, paranoid, right-wing goop. I’m not going to belabor the details of his ongoing meltdown here. Still, both Tesla and The Social Media Company Formerly Known As Twitter have designs on being the biggest companies in their respective industries. Musk is the very extremely public face and marketing vector of the companies, and as such, telling 75% of your customers what a gigantic bigot you are is probably not wise, because as MJ would (probably) say:

Liberals buy Teslas, too

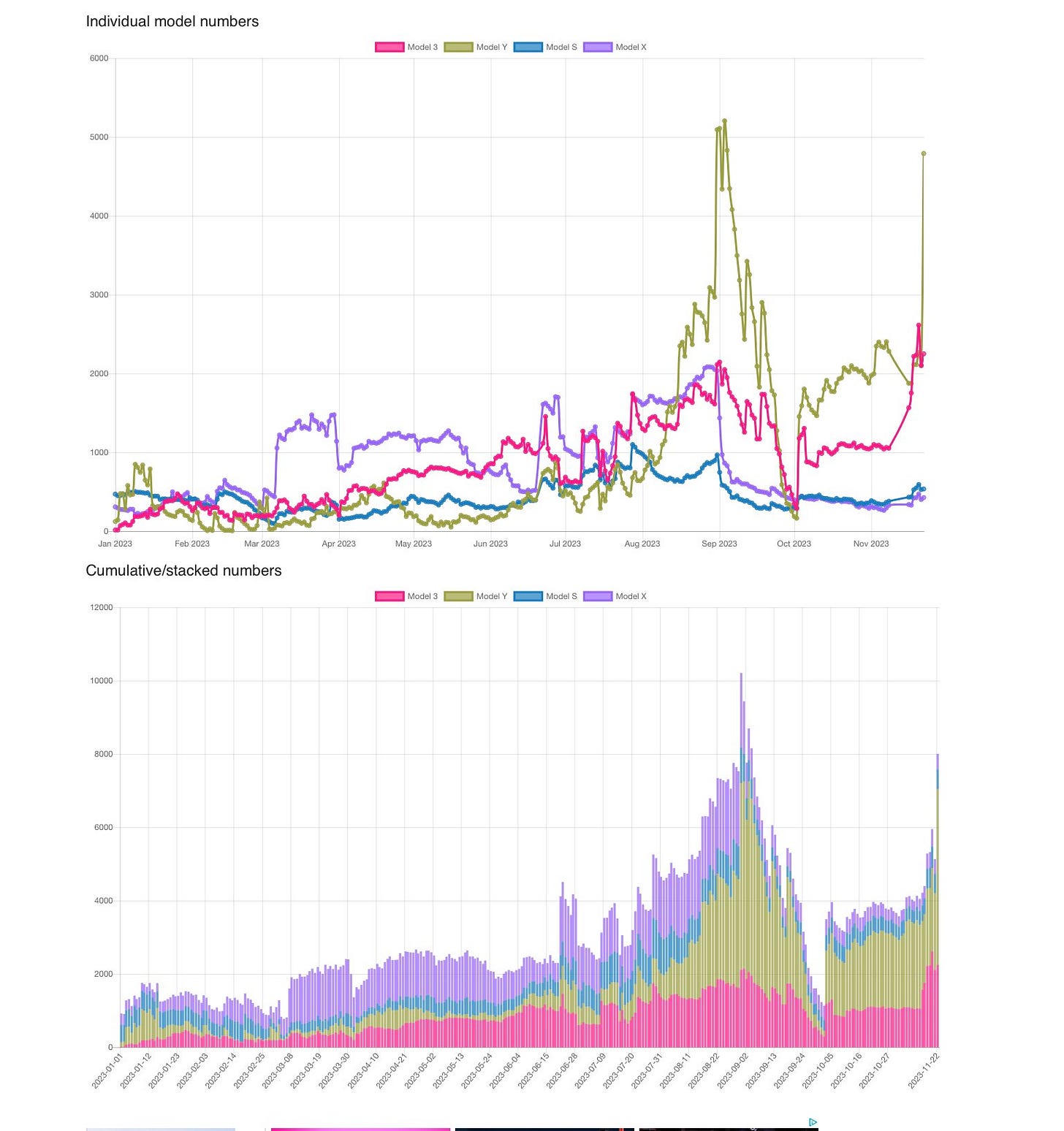

That “too” is superfluous here since market research shows that American Tesla buyers have historically been extremely “liberal.” Perhaps this chart of rapidly spiking new car inventory available for purchase on Tesla’s website explains it best:

At least with SpaceX, the company’s biggest customer (the United States Government) openly declared this week that they do not give a single damn if Musk wants to let his Nazi flag fly. But if you want to move some EV Metal or iPhone ads, perhaps it’s best to “Be Like Mike” and tone it down there, Elon.

Reg Updates

I’ve spent a few months working on a way to scan and automate new regulatory and legal happenings that can affect publicly traded equities. It’s still very much a work in progress, but here’s the inaugural issue (behind a paywall):

ESG HOUND CYBER TUESDAY DEAL: 50% off subscriptions

Tickers/Companies mentioned this week

Pesticides: $BAYRY, SYT 0.00%↑

Battery Storage/Solar: RUN 0.00%↑ CMI 0.00%↑ CATL, Samsung, LG

Hiring in Banking: JPM 0.00%↑ WF 0.00%↑ GS 0.00%↑

Vehicle to Vehicle Comms: GM 0.00%↑ F 0.00%↑ MBLY 0.00%↑ TSLA 0.00%↑

Neonicotinoid Pesticides - Will The US EPA Finally Do something about “bee killer” insecticides?

Industry Impacted (Primary) : Agriculture Chemicals

Affected companies: Syngenta, Bayer AG

Background: the use of Neonicotinoid insecticides has long been hotly contested. This class of pest control was previously widely available globally before bans in the EU started taking effect 8 years ago. Because the pesticide is derived from (and chemically similar) to nicotine, there was a faulty assumption that the insecticide would be less bio-persistent and less harmful to the natural environment. Nicotine production in tobacco plants, of course, evolved as “organic” insect control.

Neonicotinoids are extremely deadly to honey bees (and other pollinators), and this class of chemicals and adjuncts have gotten a reputation as bee killers. The interesting part is that Neonicotinoids aren’t particularly toxic to bees in that bees don’t keel over dead. But because it impacts foraging and navigation functions in individual bees, it has been responsible for the loss of colonies (perhaps to a staggering degree). The EPA has made several concessions to industry in the past decade under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), but was recently forced to complete a re-evaluation under the Endangered Species act. This Federal Register entry is for a petition that is being considered and given the latest science, the new EPA administration, and general public sentiment, companies with an economic interest in Neonicotinoids should be concerned.

Dollars and Cents:

Roughly 3% of Bayer AG’s sales are this class of insecticide (or $500 million for current fiscal year). Syngenta sales aren’t directly broken down, but the top line impact is likely in the $1-1.5 billion range

A negative determination from the EPA could essentially kill use of the insecticide globally, finishing off what Europe started in 2018.

Outlook: EPA has a helpful docket tracker here.

Potential Impact: 🔴 NEGATIVE

Battery and Solar Installs - Will green energy get a break from National Permitting requirements under NEPA?

Industry Impacted (Primary) : Solar Panels, Batteries, Wind Turbines

Industry Impacted (Secondary) : Utility Companies, Engineering and Design Firms

Affected companies: Panasonic, CATL, NextEra Energy, Duke Energy, Excel (among others)

Background: The National Environmental Policy Act (NEPA), which has been covered exhaustively on this silly substack, is a infrastructure law that requires extensive environmental review for any project that the US Federal Government has an interest in. Often this is for things like development of projects on federal lands or projects explicitly backed by the government operationally. But a plain English reading of the law also means projects that are funded by a federal agency may fall under NEPA which can add years of review before approval is given.

The Department of Energy (DOE) has a massive war chest of funds to hand out for green energy, but because of this funding mechanism, there has been some hesitation to accept funds because of logistical holdups (such as NEPA approval). This rule is intended to clear some of these hurdles, and while some people don’t love the idea of bulldozing bedrock environmental review laws, this reform should absolutely help.

Dollars and Cents:

DOE has a $400 billion warchest. Many companies forgo DOE loans for financial reasons (and these are unlikely to change since Solyndra is still the bogeyman of the industry), but the unlock of some permitting requirements will make that money flow easier, and Jigar Shah (DOE’s head of the program) won’t have to go pitch the loan program on podcasts.

Outlook: There is bipartisan support for this sort of permitting reform. Expect green energy buildout to pick up in the 2025+ era. Massively bullish in the medium term

Potential Impact: 🟢 POSITIVE

Fair Hiring in Banking Act - Banks go woke?

Industry Impacted (Primary) : Banking

Affected companies: Any bank regulated or covered by the Federal Deposit Corporation

Background: The Fair Hiring in Banking Act (signed late 2022) is finally being rolled out to individual agencies and companies. This law isn’t likely to alter business whatsoever. But what is interesting is that anti-discrimination laws in the US have generally involved inherent traits (Race, Gender, Disability, etc). But the FHBA includes protections for people who were charged with minor offenses. Drug possession and misdemeanors have prevented many from working in FINRA or FDIC-regulated industries.

Dollars and Cents:

Two million Americans work in FDIC-regulated jobs affected by this law, with a mean salary of $74,000.

Outlook: Your next mortgage broker might have been charged for possessing marijuana

Potential Impact: 🟡 NEUTRAL

I've been rewatching the Newsroom actually with my wife (who never saw it) and it definitely has some cringe moments and I'm a huge West Wing fan. I think the fatal flaw with the show was that Sorkin tried to 'redo' the news with hindsight and it just comes off as shitty. The tone was way off at least in the first season.