Here it is, folks. The first of what I hope to be many ESG Hound exclusive long/short ideas; but first, a disclaimer:

I do not trade individual stocks. I have no position in GEVO or GPRE, either in common stock, options, grants, bonds, NFTs, lootboxes and have no intention to do so anytime in the future. I was not compensated for this work by any third party. This post is just my viewpoint and is extremely not investing advice.

The Big Picture

Gevo, Inc is a zero revenue biofuels company that is riding an ESG wave and lots of bold promises to a lofty valuation. It trades at a 10x premium to established peers based on 2025 projected volumes, despite no established track record in the space.

Management claims that their fuels are not just low carbon, but have a wildly net negative carbon impact. I’ll show you the slight of hand they use to get there, one easily available to traditional oil refiners.

In part 2 of this post, to be released at a later date, I’ll show you how their claims that the corn they have contracted as a feedstock acts as carbon sequestration are at best not reliable and at worst incredibly misleading.

Let’s cut to the chase here. Gevo, Inc (Ticker: GEVO) is a Colorado based renewable fuels and chemicals company who has made a splash in equity markets over the past 9 months. They’ve made some big promises, rode the STONK wave of early 2021 and sold $350 million in shares in January to pad the balance sheet and pay for future projects. GEVO went from penny stock territory as of November 2020 up to as high as $14/share and a $3 billion market cap. The equity has come down to earth some and the company’s value is in the $1.1-1.3 billion range.

I’m not a finance wizard so I’ll save the long history of the company and the more nuanced financial analysis for someone more suited for the task. I’m an ESG blog, so we’re gonna talk ESG, dang it.

Here’s a description of the company’s assets

A 50 million gallon per year ethanol from corn plant in Luverne, Minnesota, which they intend to convert to a similar fuel from fermentation process

An operating agreement with South Hampton Resources to jointly operate a Biorefinery in Silsbee, Texas

I’ll let their Q1 earnings press release do the talking:

Revenue for the three months ended March 31, 2021 was $0.1 million compared with $3.8 million in the same period in 2020.

During the three months ended March 31, 2021, hydrocarbon revenue was nil compared with $0.1 million in the same period in 2020.

During the three months ended March 31, 2021, no revenue was derived at Gevo’s production facility in Luverne, Minnesota (the “Luverne Facility”) related to ethanol sales and related products, a decrease of approximately $3.7 million from the same period in 2020. As a result of COVID-19 and in response to an unfavorable commodity environment, Gevo terminated its production of ethanol and distiller grains in March 2020. Gevo’s Luverne Facility is not currently producing ethanol but is performing maintenance in preparation for isobutanol production expected to begin in June 2021.

This is a no revenue company at its current juncture, meaning the market is pricing in promises in the future. So let’s hop on over to the June investor presentation and take a quick loo…

Oh god.

Oh no.

Well, hmm, not a great sign. This is giving me flashbacks to 2017 and Iced Tea On the Blockchain.

*Note to Gevo management: the only reason I started digging more into y’all was because of this slide. Advertising a minor part of your business going on the blockchain is like a siren call “Thar be dragons!” to a uh… Dragon Hunter

Now, Gevo’s current assets are not all that exciting. In fact, the company doesn’t really talk much about them. What’s really important are the future projects:

A 355 thousand MMBtu/year Renewable Natural Gas Facility in Iowa. Start up projected in 2022

A “Net Zero” Hydrocarbon production Facility in Lake Preston, South Dakota, capable of producing 45 million gallons of jet fuel and isooctane (high value component of gasoline); Start up projected in 2024

As a way of comparison, Green Plains Inc. (Ticker: GPRE), the biggest pure play biofuels company in the US, has a market capitalization of $1.7 billion. They currently have production capacity of 1.1 billion gallons of ethanol per year. Trailing 12 month revenues are $2.2 billion, for a price to trailing sales ratio of 0.77.

Gevo Inc. has a market capitalization of $1.2 billion. They currently have production capacity of 50 million gallons of ethanol per year. Trailing 12 month revenues are $1.5 million (with an M). Future capacity in 2024 is projected to be 110 million gallons of combined biofuels. While there are no explicit forward revenue guidance, you can estimate maybe $1.5 billion dollars in sales annually (someday). Considering the current new facility making 45 million gallons per year is projected to start up in 2024, that additional 394 million gallons is likely many, many years off. Forward (10 year+) price to sales multiple is roughly 1.0 and will require tons of CapEx.

On a valuation basis, Gevo trades at a ludicrous premium to its peers. The market has essentially given them a 8-10x premium for volumes that might happen in the next 3-4 years.

The Gevo difference, as advertised by executives, is as follows:

Rather than fermenting corn into ethanol, they use a strain of yeast that ferments isobutanol which can be more easily converted into isooctane (a gasoline additive) and Jet fuel. As of date of publication, Jet fuel trades ~25% lower than ethanol and isooctane trades at a ~50% premium, for a blended 20% price premium over ethanol

They have a special, proprietary process that allows them to make negative carbon fuels.

They also project that corn farming can be done in the near future that also is carbon negative

The financial numbers are what they are, but my aim here is to demonstrate that their ESG special sauce is likely nothing more than smoke and mirrors and doesn’t deserve a price premium.

About Cow Farts

Gevo’s proposed Renewable Natural Gas (RNG) facility is essentially a scaled up set of digesters (e.g. big ole tanks). Manure from dairy farms in Iowa is trucked to Gevo’s plant, dumped in the digester. Water is added, and through the magic of a series of microbial redox reactions, methane is generated. The methane heavy gas is likely run through a knockout vessel or small gas column to remove impurities and water, the gas is compressed and sent into the pipeline.

This is, of course, not a new technology. There are several hundred facilities in the US that collect biogas from manure, wastewater, landfills, etc.

What’s important here is the math.

For climate impact/ESG purposes, you’ll often see the notation CO2e. This term usually refers to the more specific CO2e-100 factor. A quick explainer is as follows:

Pound for pound, various Greenhouse Gasses have different impacts on Global warming (or Global Warming Potential/GWP) based on modeling and EPA/IPCC guidance. The CO2e factor normalized these emissions after 100 years in the atmosphere. So, for example, each pound of Methane released into the atmosphere is considered equivalent to 28 pounds of CO2. See table below:

So, as an example, if I have a pound of methane and I release it into the atmosphere, I’ve generated 28 pounds of CO2e. If I light that methane on fire and it completely converts every molecule of CH4 (methane) to CO2, I’ve now released only 2.7 pounds of CO2, which is also 2.7 pounds of CO2e. That’s a 90% reduction in greenhouse gasses.

How to Make Carbon Negative Gasoline

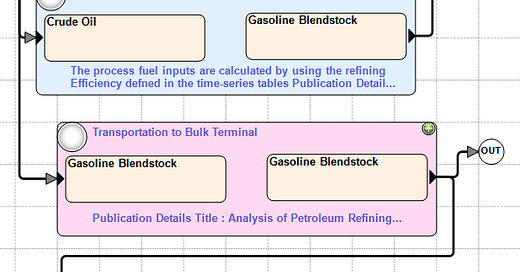

I’m going to show you a trick an oil refiner could pull tomorrow. Let’s say I’ve got a copy of GREET, the industry and government standard Lifecycle Analysis (LCA) tool. Let’s take a look at production of gasoline from crude in the United States.

GREET lets you make custom flow charts using inputs from all sorts of processes and feedstocks to let you know the net carbon impact of an activity. So, in the example above, we take regular, average US crude from the ground, transport it, distill it, catalytically crack it, blend it and then ship it off to a gas station or terminal.

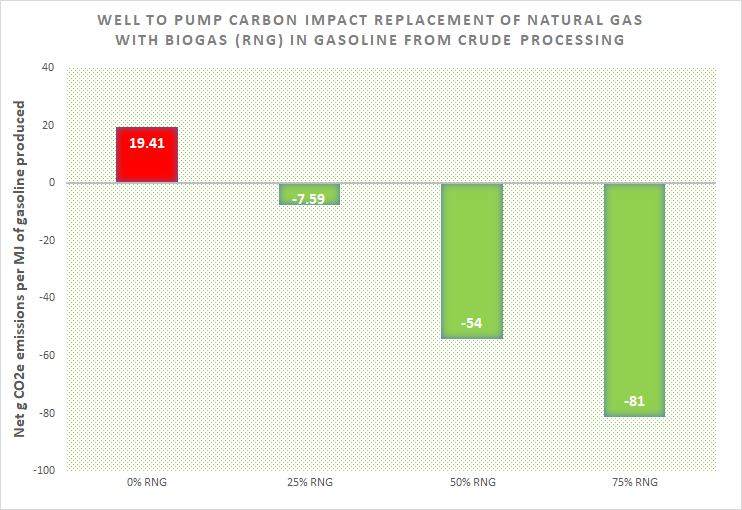

Each Mega Joule (MJ) of energy in the final gasoline resulted in 19.41 grams of CO2e going into the atmosphere, or its net Carbon Impact (CI). Still with me here? Good. Now let’s take a look at the “natural gas from animal waste” used as an intermediate fuel.

For every MJ of RNG made from this process, we get *negative* 90 grams of CO2e!

The underlying assumption of the software and methodology is that that manure would otherwise break down into methane in a pit, wastewater or on the ground and go to the atmosphere. By combusting it instead, we’re nullifying 25.3 grams of carbon for every pound of methane (roughly 105 grams per MJ).

A Thought Experiment in Traditional Refining

Let’s take a look at a standard crude refinery:

I’ve bounded the exercise to primary distillation in the red box for simplicity’s sake because this step is standard, universal and easy to understand. Raw crude is heated through a boiler or steam heat, put through a distillation column and the basic feedstocks to downstream processes come out of the column based on the relative densities of each crude fraction. The heat for this system generally comes via combustion of pipeline natural gas.

Here’s a simple mass and energy balance for this bounded system in the red box:

To perform primary distillation on crude, we need 0.54 MJ of energy for every kg of crude. This is to heat up the crude so it separates in the column.

Now, let’s assume that we replace 25%, 50% or 75% of the heat fuel used for this process with RNG from cow manure. We do some simple unit conversions and voila!

I’ve made carbon negative gasoline by the logic used in the GREET lifecycle model. Now this is the carbon impact from just production, so if we assume that the gasoline gets burned in a internal combustion engine (ICE) car, using a generic GREET factor of 70 gCO2e/MJ, we get the following:

If I’m a refinery and I replace 75% of my input fuel for primary distillation with Renewable Natural Gas, I can claim net zero carbon emissions! (75% is a good upper bound, because waste gas from downstream processes typically accounts for 25% of heat in primary distillation).

Tying it Back to Gevo

Let’s take a closer look at Gevo, knowing what we know about how LCA logic works.

I have serious concerns about the planned base case of -5 grams carbon impact, but since that rests on their claims about corn sourcing, I’ll save it for the next installment.

But let’s take a look at the improvement from -5 g CO2e to -28 g CO2e cradle to cradle emissions. This is the exact same logic I used in my refinery example above. The -5 gram value is using natural gas as a fuel input for their own distillation/reaction/ blending process. The -28 g value is from substituting that process heat fuel for RNG.

So the claim is that if they make and produce RNG, then burn RNG as process heat to produce their biofuels, they take the offset and claim that their fuels are turning:

grain->fermentation->distillation->combustion in a car or plane

Into not just a lower carbon alternative, but effectively a carbon sink. The more fuel they make from corn and burn in cars, the more they reduce global warming or carbon impact!

The above logic creates a potentially severe market distortion. The GREET model assumes animal waste from manure as a given, so any capture of this waste and conversion into methane is something that can be gamed by so-called ESG companies. Rather than limiting sources of emissions in the first place, it incentivizes creation of perpetually more waste that can be processed “greenly.”

This isn’t a process or technology breakthrough, it’s gaming LCA software outputs to give the appearance of being exceptionally green. Ethanol production is absolutely a carbon generating exercise at scale. This is merely bootstraping the carbon offsets from animal waste fuel capture (a great and good thing to promote) into a rather run-of-the mill biofuels business. It’s Greenwashing 101, and it makes for a rather flimsy ESG case, especially given the underlying financials. It’s not an equity I’d feel comfortable holding for many reasons.

We’ll wrap this up in Part 2, covering the farming carbon sequestration claims, which appear to be patently absurd as well

So until next time, Love always,

ESG Hound

Great thoughts here and for similar reasons I'm bearish on GEVO and their process, however what do you think of Cielo Waste Solutions? I'm a big fan of their process and have a decent position