Have you subscribed yet? Click the link below for 2-3 free newsletters per week, including the soon-to-be famous Weekly Roundup

Ridiculous ESG Rating of the Week

Today, I come bearing gifts! We’ve covered cigarettes and we’ve covered slave cocoa bean labor in the last two installments. In fairness, and after some introspection: at the very least, chocolate and a smoke to go along with a pint after a long week makes you feel good.

You know what doesn’t feel good? Bombing other countries into oblivion. Creating a generation of disabled veterans larger than the one that came back from Vietnam feels pretty shitty too. War: it’s bad, right? Right???

Those of us who came of age in the 9/11 era can recall the jingoism and the rage. I still remember the feeling of wanting to do something in the years following the attacks. Remember freedom fries? What about “YOU CAN’T CRITISIZE A WARTIME PRESIDENT?”

I was a college freshman when they rolled tanks into Iraq on a crisp and beautiful spring day. March 2003. I still clearly recall, as if it was yesterday, walking off campus to a friends house to study organic chemistry. A slight breeze. The faint smell of marijuana smoke. And from a fraternity balcony, I heard it. Outkast’s 2000 hit “B.O.B.” blaring from the speakers of a rich kid’s stereo. You know, “Bombs over Baghdad,” on repeat. That song still whips, don’t get me wrong. But I always think about this exact moment every time I hear it. Some 20 year old kid, completely bereft of irony or introspection. Not just the frat guy. I was guilty of it too. While I was too self serious to outwardly enjoy the invasion, it still felt, in a way… good? We had to do something after 9/11, right? For many, it was a celebration, baby.

I lost two friends to the wars in Afghanistan and Iraq. Three if you count the friend who came back completely changed. His brains scrambled from IEDs, unable to outrun the images of mangled children and hollowed out cities that replayed every time he closed his eyes. He’s a opioid addict now, or at least last I heard. I wonder where he is now.

I don’t have anything funny to say about this week’s rating. So here’s the score:

Northrop Grumman has an S&P score of 64/100. 98% of their revenues come from the US government. An overwhelming majority of them are used to create weapons of death and destruction. These tools are used to colonize nations that are beneath us, the greatest country the world has ever seen. To track and kill drug runners. To destabilize nations.

Northrop spends 12 million dollars per year to bribe politicians, a sizable, but ultimately insignificant kickback from the $37 billion it rakes in from the Department of Defense.

In aggregate, their employees don’t care who wins either. D or R, Red or Blue. It all keeps the war machine oiled.

The company sends an exactly equal amount to each party’s Senatorial and Congressional committees. That’s the biggest tell in the world.

It’s darkly funny that while Northrop is dinged for Product Stewardship and Human Rights, they absolutely knock it out of the park on Operational Eco-Efficiency.

My Thought and I sure hope I don’t have to tell you this:

🚨Don’t buy a merchant of war if you are running an ESG strategy of any sort🚨

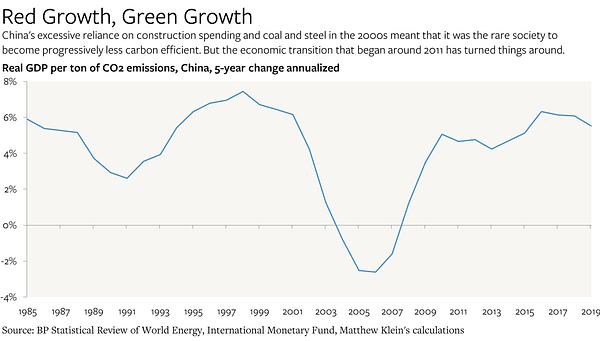

Climate and the War Machine

Staying on topic, and finally getting around to revealing the clickbait teaser in this week’s header: The US military is an absolutely massive source of global CO2 emissions:

That accounts for ~1% of the United State’s emissions, which doesn’t sound like a lot. But the number may be undercounting by as high as a factor of 10, considering the ~60 million tons is basically associated with just fuel use and building operations associated with DOD. Manufacturing isn’t in there, and most knock on effects, such as destabilizing entire regions and inciting armies and militias to arm up and move around aren’t either.

As an aside, this is an excellent paper from Brown University about the Climate impacts of the war machine.

It’s of course not “one weird trick” to fixing climate change, and come on, you should know better than to trust terrible headlines.

Here’s a chart of DoD official Carbon emissions by year:

It’s mostly flat every year, because after all, consumption is GDP and GDP is heavily dependent on spending on war: 4% of US GDP is from DoD spending, after all, and we wouldn’t want to, I dunno, staff up the Army Corps of Engineers instead of buying more bombs. And if you’ve got bombs and your suppliers need to make more bombs to keep their equity performance awards up, then you sure as shit are gonna find somewhere for those bombs to go “BOOM.”

Lawmaking Updates

It was all Afghanistan all the time in DC, but some very interesting updates on the murder robot car front. The new NTSB chair had some choice words, definitely not targeted directly at one company.

Probably just a coincidence that this happened the same week that NHTSA opened an investigation against Tesla’s Ambulance hunting machines.

EPA is set to recommend biofuel blending mandates be relaxed for next year. Not great news for the sector, which remains a very mixed bag in terms of actual sustainability. ESG Hound fav Gevo, Inc is surely thrilled.

The house is back in session this week. Infrastructure is, again, expected to be the main topic of discussion.

Tweets/Blogs/Articles that Caught our Eye - OnlyFans and Afghanistan

So I’ve seen this theme discussed a few places and it brings up some interesting questions. Why do we still have such a puritanical take on sex? Human trafficking is absolutely something that we should be concerned about, but banks holding the pornography industry to an impossibly high standard, especially given their lax treatment of other industries with dangerous externalities (see: Defense contractors). Porn is still taboo, but might embracing it be socially progressive?

Must read piece. I enjoyed it tremendously.

ESG Hound TL;DR

Water water water! Still on the lookout for drought chat to take off. More on VWTR eventually. In the meantime, check out the Q&A session from last week.

This week, I’ve got something that’s a bit different. No spoilers though!

I thought I was done with Gevo, but now I’m not so sure. Every time I dig, I find something new.

ESG Hound Portfolio

🚀 VWTR - Vidler Water Resources, Inc - Added 7/15/21 - LONG

Price at initiation: $13.10

Current Price: $13.97 (📈 +6.6% for the “fund”)

Move this week: (+2.2%)

💨 GEVO - Gevo, Inc - Added 8/4/21 - SHORT

Price at initiation: $5.60

Current Price: $4.98 (📉 +11% for the “fund”)

Move this week: (-5%)

![Report: The U.S. Military Emits More CO2 Than Many Industrialized Nations [Infographic] Report: The U.S. Military Emits More CO2 Than Many Industrialized Nations [Infographic]](https://substackcdn.com/image/fetch/$s_!o4P6!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fd8318958-4e96-4ae0-96bb-dec131f909c7_960x684.jpeg)