ESG Roundup #4 - Allowing customers to clear shelves of dewormer paste is probably not good

...and other perhaps more notable news

Have you subscribed yet? GUARANTEED TO RAISE YOUR IQ BY AT LEAST 20 POINTS OR YOUR MONEY BACK

Ridiculous ESG Rating of the Week

Well, well, well. This one is a no brainer. It turns out that self reporting questionnaires and treatment as a PR campaign isn’t the best way to philosophically or logistically approach ESG metrics.

Deutsche Bank, this week’s winner, despite the long standing reputation as the go to bank for terrorists, drug cartels and passthroughs for laundered money, filled out S&Ps surveys, checked all the boxes needed and somehow came out with a surprisingly robust 55/100 score:

It was 77 in 2016 so the trend isn’t looking great as is. But raw scores aside, this week’s news is that an investing organization inside the bank is under investigation for just straight up lying about ESG metrics. From the Wall Street Journal:

U.S. authorities are investigating Deutsche Bank AG’s DB +1.25%asset-management arm, DWS Group, after the firm’s former head of sustainability said it overstated how much it used sustainable investing criteria to manage its assets, according to people familiar with the matter.

The probes, by the Securities and Exchange Commission and federal prosecutors, are in early stages, the people said. Authorities’ examination of DWS comes after The Wall Street Journal reported that the $1 trillion asset manager overstated its sustainable-investing efforts. The Journal, citing documents and the firm’s former sustainability chief, said the firm struggled with its strategy on environmental, social and governance investing and at times painted a rosier-than-reality picture to investors.

I try to illustrate, every week, how absurd using standardized checklists and metrics is for ESG scoring. It’s like if you score ok on 9 out of 10 human rights metrics but the tenth is a zero because you, say, enable a child slave trafficking organization, your score gets hit, but only to an extent. If you were to run a human murder factory as a business, the pollution control device you slap on the top of the building doesn’t get to wallpaper over the huge negatives. Zero bounds on scoring is a large part of the problem.

I’m not pitching solutions to these problems. But treating ethics and sustainability as an accounting exercise, and trying to quantify the risks, as these agencies do for credit scores, in a parallel manner can be problematic. (I am indeed just lobbing bombs with this segment, in case anyone was curious.)

All that being said, the DB news in particular is just too damn perfect. Many treat ESG like a joke as is; a necessary PR exercise to keep the money flowing. But even then, it’s clearly not even treated with the same gravitas as accounting is. Most accounting fraud today is complex and esoteric, not just straight up faking top line numbers (Wirecard, another German entity, aside). But this ESG fraud case appears to be similar to the laziest accounting shenanigans imaginable.

Until ESG disclosures are treated with the same seriousness as they are presented to potential investors for, say, Green or Ethical or Sustainable funds, they won’t matter. That’s why this news is big and exciting. The first ESG fraud case. Surely there are no more of these to come?

Some free advice to the Tractor Supply Company

Look, this is probably stretching the limits of being in scope for the “S” in ESG, but let’s talk about Ivermectin for a second. Getting your hands on a tube of an equestrian formulation (apple flavored!) of the over the counter anti parasitic medication is damn near impossible currently, as a rabid but shockingly large segment of the American public is convinced that it is a panacea for the prevention and treatment of the Covid-19 virus. Unless you’ve been living in a cave, you probably know about this phenomenon; it is playing a not-insignificant role in the ongoing Covid surge throughout much of the South, as this belief is nearly universally associated with anti-vaccine rhetoric.

Anyways, how did we get here? That’s an interesting discussion that’s far too complex and lengthy for this post. Until the middle of this week, there were numerous subreddits and public Facebook groups, numbering in the tens of thousands of users, where people doled out fake medical advice, anti-vaccine conspiracy theories as well as human dosage instructions for ingesting medicine made for 2000 pound farm animals. Facebook shoulders much of the blame here. I’m not even going to suggest they actively sensor all posts, but I think it’s clear the same algorithms that generate so many clicks for their advertisers have the unfortunate (or perhaps intended) effect of leading people down rabbit holes and into echo chambers where dangerous, destructive and false ideas and suggestions are repeated and self-reinforced until they replace tangible reality.

Facebook, now forced into action, will continue to cull the Ivermectin groups as they pop up, as they started doing after news outlets wrote about the phenomenon. But the problem here is systemic. Going after individual groups and conspiracies well after they’ve taken root into the American consciousness is tremendously lazy. The next QAnon or bleach enema therapy is already out there, incubating. Facebook’s AI and metric optimization algos will allow this currently unknown, nascent and perhaps dangerous movement to take hold. And as sure as the sun is to rise tomorrow, Facebook’s software will actively fertilize the movement and spread it across their platform to the billions of people connected to the network.

Facebook should obviously do something about this, but the conspiracy machine is intimately tied into their means of making so much money, so expecting them to take meaningful, radical action is a fools errand.

On the supply side, there is a nationwide shortage of all Ivermectin containing products. Pastes, creams, pills and shampoos fly off the shelves the second they’re restocked.

Now, let’s say I’m the CEO of Tractor Supply Company (TICKER: TSCO), a 20 billion dollar retailer of farm suppliers with hundreds of stores nationwide. I probably oversee the biggest distributor of Ivermectin containing products in the country. I am aware that my customers are gobbling up horse pastes and sheep drench solutions; they fully intend to eat, inject, smear themselves with the products. Some people are even giving it to their children! But I’m not in the business of selling medicines to humans, I sell stuff for farmers to do farming. Ivermectin makes up a tiny percentage of my sales. Maybe I could do something to stop this.

Sadly, while apparently broadly out of stock nationwide, The Tractor Supply Company’s website still lets you go through the motions to order Ivermectin for curbside pickup and delivery and tells you which stores have some in stock.

Local Facebook groups share when TSC gets more dewormer pastes and syringes in stock. Look, it’s absolutely not your responsibility to tell people what to do with the products they buy from your store. But that doesn’t mean you can’t do something proactive, such as require IDs, coordinate with local vets or I dunno, maybe update your website with something explicit about not using it for Covid therapy beyond the bog standard “NOT FOR HUMAN USE” in 12 point font on the product page.

It would cost nothing, have minimal impact on revenues and would be a good thing for society to try to do something to prevent horse drugs from circulating among people. Just thinking out loud here.

Lawmaking Updates

I’ll admit I didn’t notice anything I have interest in writing about this week, but keep on looking out for some movement by the NHTSA on Tesla’a Autopilot. This, along with the numerous crypto investigations, could signal a sea change in how US regulators get some of their mojo back. I’d love to see at minimum a return to the early 00’s regulatory culture, as it’s been a free-for-all since 2006 or so.

Tweets/Blogs/Articles that Caught our Eye

Team ESG fights back - Robert Armstrong FT

This piece is a whirlwind and covers almost every coherent critique against ESG Investing (or at least how it’s currently constructed). The whole thing is a must read; here’s my favorite bit:

ESG will have more impact when we better define what it means and what we expect ESG-compliant companies to do. The problem of defining and measuring companies’ success in meeting ESG standards is every ESG investment consultant’s favourite problem, because it seems solvable and is sure to provide long-term employment.

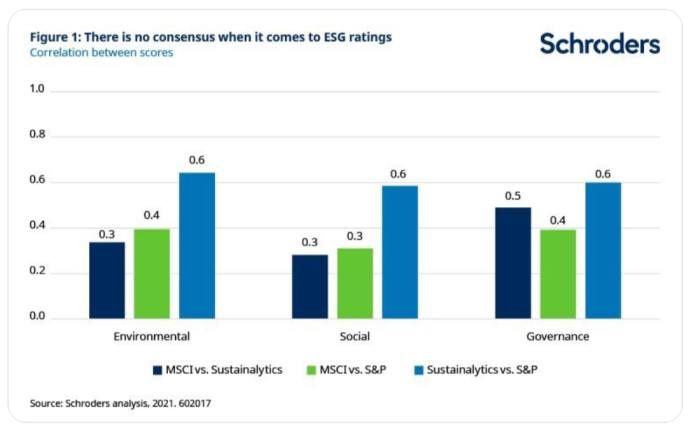

Indeed, there are no uniform standards. The insightful Duncan Lamont of Schroders recently tweeted this chart, showing the lack or correlation in judgment among different ESG scoring systems:

I just don’t want evil companies in my portfolio, so I choose ESG funds. Fair enough. But remember, if your ESG fund invests in secondary markets, the companies involved are not using your capital either way, and the effect on those companies of the fund’s buy/sell decisions are very moderate. Don’t feel too good about yourself; vote, call your senator, boycott, donate, purchase carefully, and then feel too good about yourself.

Liz Simmie is a must follow if you want to see a great way to think about ESG investing philosophically. This interview was cool and she has my full seal of approval.

ESG Hound TL;DR

Gevo released a preposterous PR on Thursday, which appears to be directly aimed at my assertion that they are behind on construction at their Net-Zero facility. This set off a 28% rally, which is cool and normal. Much to come on this front, early this next week. It’s gonna be good!

Working on a piece on Oatly (Ticker: OTLY), the vegan milk company with a high valuation and some ESG accusations over their heads.

ESG Hound Portfolio

🚀 VWTR - Vidler Water Resources, Inc - Added 7/15/21 - LONG

Price at initiation: $13.10

Current Price: $13.85(📈 +6.4% for the “fund”)

Move this week: (+0.1%)

💨 GEVO - Gevo, Inc - Added 8/4/21 - SHORT

Price at initiation: $5.60

Current Price: $6.58 (📉 -17% for the “fund”) ed. note: OUCH!

Move this week: (+32%)