MicroStrategy, ESG and Bitcoin

How do we start thinking about benchmarking indirect CO2e emissions?

There’s been enough digital traffic covering Michael Saylor (the CEO of MicroStrategy, Inc Ticker:MSTR) and his deranged foray into bitcoin maximalism to power a single Bitcoin mining rig for a few weeks.

Excellent blogger, and friend of the ESG Hound, Doomberg Terminal, absolutely tore the man to shreds in this essential, viral piece. I won’t waste much time on the finances, market mechanics or other potentially fraudulent spinning discs that Mr. Saylor is toying with. I want to talk about Carbon.

CO2 emissions are the lynchpin of the “E” corporate ESG world. I think they hog far too much of the attention in this area, but I understand it. Carbon emissions are the single biggest driver for climate change and, as such, play a massive role in how our world looks 5, 10, 50 years from now.

CO2 emissions are typically presented as Carbon Dioxide Equivalents (CO2e) emissions. For those not well versed in the field, the theoretical warming potential of other Greenhouse Gases (GHGs) are often many times greater as a function of mass. For simplicity sake: 1 pound of Methane emissions has the potential to create as much warming on a pound per pound basis, as 25 pounds of direct CO2 emissions. This is a bit simplistic and reductive, as methane fairly rapidly undergoes a redox reaction in the atmosphere and becomes less potent at warming over time. Realistically, and per empirical studies, the warming potential of methane is actually ~85x that of CO2. But for simplicity’s sake, we’ve accepted 25. A reasonable, but again imperfect metric.With all of that fun out of the way, let’s do some algebra!

Calculating the actual carbon impact of bitcoin is an exercise in assumptions, some of them more based in reality than others. The form of energy used to make bitcoins matters, obviously. Coal power plants burning high carbon sources of pollution create more than, say, a hydroelectric plant. Power itself is somewhat (but not completely) fungible. So just because you use a wind farm to mine your bitcoins, that doesn’t get you off the hook, because that wind power could be used to do something productive instead. Likewise, the cards used to make bitcoin mining rigs have carbon emissions associated with their manufacture. The carbon footprint of rare earth mineral extraction isn’t just an emission factor you can multiply by, because each ton of incremental rare earth metal mined makes the next ton that much more energy intensive to extract, I believe for obvious reasons.

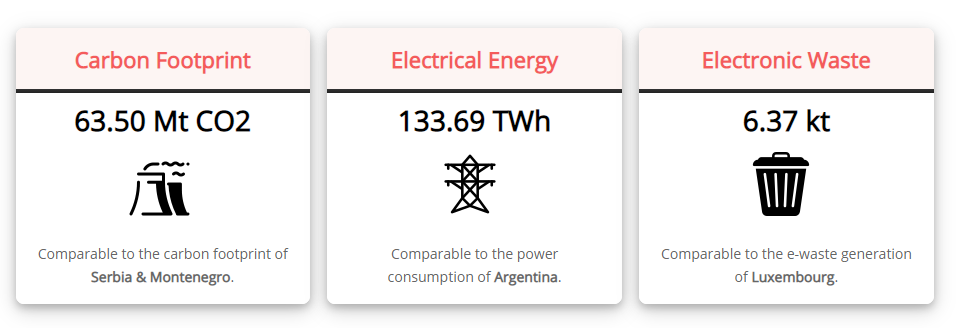

I think that Digiconomist’s calculator is pretty damn good all things considered. They have current CO2e emissions for “Bitcoin” as an entity at 63.5 megatons, annually.

Bitcoin is funny, in that we call the creation of Bitcoins “mining.” But it’s really not mining at all, even ignoring the fact that there are no shovels, trucks or smelters involved. Mining any other entity, such as gold, has an embedded cost of extraction, environmentally and economically, and then it’s done. Bitcoin is a vampire that requires the insane amounts of power to even exist. A bar of gold sits on the ground and exists, whereas a bitcoin requires perpetual sacrifice to the gods of energy to even be a thing. It’s a mass balance nightmare.

MicroStrategy is currently sitting on a well publicized hoard of 105,085 bitcoins.

There is a total current number of 18.75 million bitcoins in existence. At least 4 million of these coins are abandoned (likely forever). So for argument’s sake, there are currently 14.75 million bitcoins that are tradeable, usable, etc.

MSTR holds roughly 0.7% of the active supply of bitcoin. And is thus, responsible, indirectly for 452,000 tons of CO2e emissions per year, or 996 million pounds. MSTR is, officially, a software company. With roughly $480 million in revenues in 2020, that means for every dollar of revenue generated, MSTR is responsible for 2.07 pounds of CO2. A SOFTWARE COMPANY! And this is assuming the rest of their business generates zero carbon footprint.

Western Midstream Partners (Ticker: WES) is a pipeline company with 15,000 miles of pipeline delivering crude, natural gas and refined products. Their 2019-2020 ESG report indicates that they were responsible for 3.5 million tons of direct CO2e emissions and 0.97 tons of indirect emissions. The company brings in $2.7 billion in revenues, and while revenues are hardly a perfect proxy of economic value, for comparison’s sake, that is 3.66 pounds of CO2e for every dollar of revenue.

A company that traffics in literal carbon emissions as a core of their business has only 76% more CO2e generated as a function of revenue as a capital light, boring software company. Considering that MSTR’s bitcoins themselves offer zero economic value, I’d argue that their environmental “sins” are orders of magnitude more egregious

There isn’t much in terms of ESG rankings for MSTR and all I have to go off on currently is via CSRHub:

It’s shameful and embarrassing that our capital markets allow this to happen.

Until next time, hugs and kisses from the ESG Hound

Disclosures:

I do not trade individual stocks. I have no position in MSTR or WES, either in common stock, options, grants, bonds, NFTs, lootboxes and have no intention to do so anytime in the future. I was not compensated for this work by any third party. This post is extremely not investing advice.

Do carbon credits make sense to help lower carbon emissions? .. why not use the 4 Principles of Market Environmentalism (cedarowl.substack.com) to lower or minimize carbon effluents - in an absolute sense, like through decentralized solutions and technology and innovation? .. “Phantom carbon credits are worse for the environment than no carbon credits” - ft.com/content/93938a1b-dc36-4ea6-9308-…