This is an experimental newsletter format I’m testing out to see if there’s enough engagement and interest. I’ll be adding and removing sections as we go.

Ridiculous ESG Rating of the Week

I was all keyed up to write some longform posts about these absurd ratings I run into, but I’m starting to realize there are only so many hours in a week. So I intend to make this a fun weekly throwaway segment

This week’s winner is Philip Morris International - Ticker: PM

Yes that’s right: 74/100 for the legacy cigarette manufacturer from S&P. This isn’t even some holding company that has diversified into other sectors like food and beverage. They sell cigarettes and that’s it baby. I get that we should not focus too much on the past here, but let’s be honest: this industry will always exist as a function of their decades long misinformation campaign that was designed to get their hooks into millions of Americans, while actively suppressing knowledge they had that cigarettes aren’t, uh, all that great for you.

“We hired some consultants to show that we’ve got some women board members and have an office recycling program” (please ignore the millions of deaths we were responsible for).

As an added insult, Morningstar’s overall ESG rating is a bit more sober on a raw score basis, but take a look at what industry they’ve been placed in here. That’s right, Food Products. When I think of the top 10 percent of ESG food companies I want to put my investible cash in, I go right to <checks notes> Cigarette Manufacturing Conglomerates.

S&P’s sector breakdown is hilarious to me. I haven’t done the research on their climate plans or “eco-efficiency” (both perfect 100s) and maybe they’re a responsible manufacturer of a product people should be allowed to enjoy if they so desire. But the 97 on Human Rights is just too perfect:

PM’s ESG presentation for 2020, Titled “Delivering a smoke-free future” has a jillion pages on treatment of farmers, but oddly enough nothing about the decades (and still ongoing) of lobbying they did to ensure many people wouldn’t be able to enjoy the ultimate human right of, ya know… “being alive.”

Perhaps the 3 points from perfection on this factor comes from the 3.5% of farms staffed by child laborers and the S&P analyst generously rounded down that day?

Lawmaking Updates

EPA “Waters of the United States” Language update: Fun fact, if you want to make an Environmental Engineer or Regulator tear their hair out while screaming swear words, ask them to define “Waters of the United States.” The whole debacle has been going on for decades as the EPA wants to protect water that could flow into neighboring states (a reasonable desire for the Federal government given their explicit purview over interstate commerce). This definition was at first for just rivers and large lakes, but has become, at times, interpreted down to “holes from excavation filling with water are now federally protected wetlands.” After tons of court battles, EPA is looking to make more concrete guidance on the topic, which should be welcome by everyone.

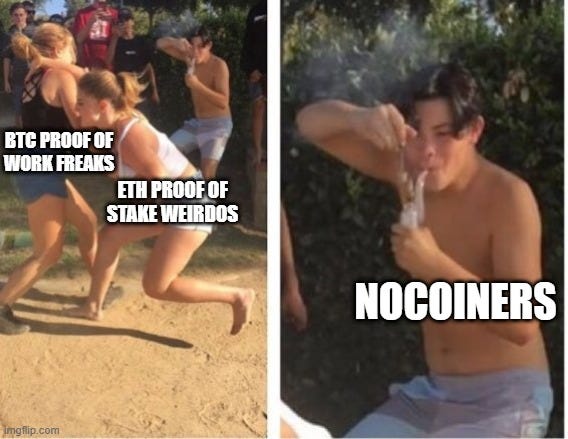

BITCOIN SHOWDOW: there’s an ongoing Twitter war regarding two competing infrastructure bill amendments. The latest (apparently Biden admin approved) one, sponsored by Warner(D)-Portman(R)-Sinema(D) is claimed to be a “climate disaster” by an authors of the competing Wyden(D)-Toomey(R)-Lummis(R) amendment.

The Warner-Portman-Sinema amendment provides a government-sanctioned safe harbor for the most climate-damaging form of crypto tech, called proof-of-work. It would be a mistake for the climate and for innovation to advance this amendment.- 2) The @MarkWarner @senrobportman version apparently introduced late tonight: https://t.co/WbC7aJl1BD

The Warner-Portman-Sinema amendment provides a government-sanctioned safe harbor for the most climate-damaging form of crypto tech, called proof-of-work. It would be a mistake for the climate and for innovation to advance this amendment.- 2) The @MarkWarner @senrobportman version apparently introduced late tonight: https://t.co/WbC7aJl1BD Nikhilesh De @nikhileshde

Nikhilesh De @nikhileshdeThe cross party currents at play here is fascinating, but as someone who (1) doesn’t particularly care about crypto’s tech and (2) thinks it’s all largely an energy vampire that could be used for anything else (Folding@Home is still a thing, y’all) all I have to add is:

EVs and Where’s Elon? : Shoutout to the Biden Administration for the Ford/GM EV media blitz this week with promises of 50% EV penetration in the US by 2030. Good luck with that, as 2021 has been notable for the electric grid in the two biggest states (TX and CA) seemingly on the verge of collapse any day. Of course, the hoopla couldn’t occur without legions of Elon Musk fans coming out of the woodwork to complain about Tesla’s exclusion from the heavily UAW attended event. Considering Tesla’s Market Cap is roughly 8x the combined value of Ford and GM, I, for one think it’s great this administration is looking out for the little guy for once.

Elon’s constant need for attention continues to be simultaneously pathetic, hilarious and aggravating all at once, so let ESG Hound have a second to give you this:

Speaking of infrastructure: The $1 Trillion bi-partisan bill is set to be passed by the Senate (today?). The Scope is reduced from the original $3.5 Trillion, but the big spend will be on building stuff to make cars go and make water flow. Expect all sorts of new greenwashing to appear in the coming years to get a piece of the action.

It’s oddly popular too.

Tweets/Blogs/Articles that Caught our Eye

Unfortunately Liz, the answer is no. Moody’s and S&P don’t cut it.

Fund Managers’ ESG Claims Face Credibility Test as Gaps Found - Bloomberg

A poll conducted last year by Schroders Plc revealed that 60% of 650 institutional investors said “greenwashing,” where the environmental benefits of an investment strategy are exaggerated or misrepresented, was the biggest thing standing in the way of their sustainability goals.

Meanwhile, demand for ESG assets seems insatiable, providing a lucrative source of business for fund managers. The market is set to exceed $50 trillion by 2025, which would be well over a third of the global total in assets under management, according to Bloomberg Intelligence.

Want to learn how to better identify actual ESG opportunities and weed out Greenwashing scams? If only someone was posting a targeted newsletter on this very topic.

ESG Hound TL;DR

On Thursday I posted about Gevo, Inc and their dubious carbon negative claims, you should read it. It’s a bit wonky, but I think it’s a cool use of LCA to counter claims from companies desperate to keep the stock up

Keeping an eye on VWTR earnings, due out 8/10/21. No near term catalysts spotted yet, but don’t sleep on TIER 2 SHORTAGE announcements to come in the next few months.

I got some great hatemail about my Bitcoin piece, including the exhausting “Bitcoin incentivizes NEW GREEN ENERGY” line, which will be debunked shortly

Coming this week: Part 2 of Crypto and the Environment and Part 2 of GEVO

Working on a new possible microcap ESG long with decent financials, making a useful product using actual recycling. Release TBD

ESG Hound Portfolio

🚀 VWTR - Vidler Water Resources, Inc - Added 7/15/21 - LONG

Price at initiation: $13.10

Current Price: $13.19 (📈 +0.6% for the “fund”)

Move this week: (-2.07%)

💨 GEVO - Gevo, Inc - Added 8/4/21 - SHORT

Price at initiation: $5.60

Current Price: $5.81 (📉 -3.75% for the “fund”)

Move this week: (-4.6%)