Weekly ESG Roundup #2

For the week of 8/15/21 - Infrastructure - Gevo - Tomatoes - Climate Change (oh my)

Have you subscribed yet? Click the link👇 below👇 for 2-3 free newsletters per week, including the soon-to-be famous Weekly Roundup

Ridiculous ESG Rating of the Week

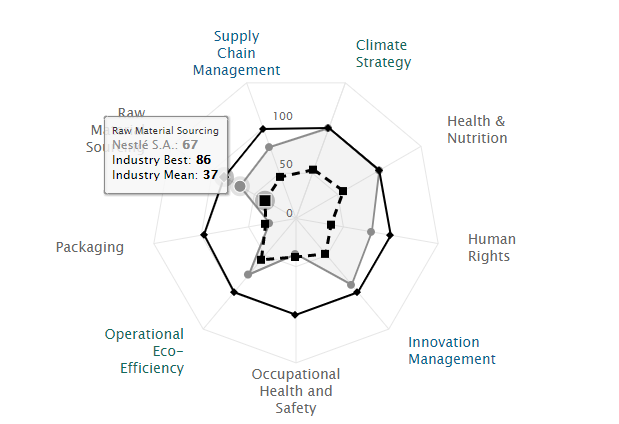

This week, a reader pointed me to Nestle SA, the Swiss food conglomerate. They have a 72/100 ESG rating from S&P.

In July, the US Supreme Court dismissed a 2005 lawsuit brought against Nestle US and Cargill by 8 workers, regarding labor practices at Cocoa Farms in the Ivory Coast.

The lawsuit also accuses the companies – whose industry body is the World Cocoa Foundation – of actively misleading the public in the voluntary 2001 Harkin-Engel Protocol, characterised by the complainants as promising to phase out some child labour (“the worst forms”, in the protocol’s words).The original deadline for achieving certain standards was 2005. In 2010, a follow-up framework of action for Ivory Coast and Ghana spoke of aiming for “a significant reduction” in the worst forms by 2020.

In the legal claim, all eight plaintiffs describe being recruited in Mali through trickery and deception, before being trafficked across the border to cocoa farms in Ivory Coast. There, they were forced to work – often for several years or more – with no pay, no travel documents and no clear idea of where they were or how to get back to their families.

The court papers allege that the plaintiffs, all of whom were under 16 years old at the time of their recruitment, worked on farms in major cocoa-producing areas of the country. The defendants’ apparent influence in these markets is described as “dominant” by the plaintiffs’ counsel.

The Supreme Court shot down the suit for “Lack of Standing,” as the alleged abuse occurred outside the US. I’m not a legal expert, and I understand that to an extent our legal systems are structurally impeded in ways that aren’t always moral. That being said, it’s definitely what I’d call “not a good look” to fight this all the way to the Supreme Court. And given Nestle’s own PR of this practice:

Nestlé was the first company to implement a system to address child labor risk in its cocoa supply chain.

Go you! Their sunny ESG presentation meant for public consumption doesn’t readily admit how many children are currently slaves but does have this cute little graphic.

Yikes.

And don’t even get me started on the California water bottling fiasco, where Nestle subsidiary BlueTriton has been coasting on perpetual water rights dating back 125 years to suck water out of the ground, bottle and sell. And again, the fiduciary duty of the company directors is to maximize profits and minimize risk so to an extent I get it. California is having none of that, though:

In an emailed statement, a spokesman for BlueTriton said that the company was “disappointed” with the move and that it would pursue legal options to correct state officials’ “misinterpretation” of California law.

“For more than 125 years, BlueTriton Brands and its predecessors have sustainably collected water from Arrowhead Springs in Strawberry Canyon,” the company said. “We take pride in being good stewards of the environment, while providing an excellent product loved by Californians.”

When it takes a massively fed up public and coordinated state regulatory action to get you to hit pause for a bit during a catastrophic drought, maybe fighting it tooth and nail is both “not ESG” and “bad for long term consumer brand awareness.”

Cool rating, guys.

Gevo Earnings Update

I don’t think this merits a separate post, but I wanted to highlight a few take-home messages from Gevo Inc (Ticker: GEVO) earnings posted on Thursday. Parts 1 and 2 of my dive into the company’s greenwashing can be found here (post on RNG) and here (post on Farming).

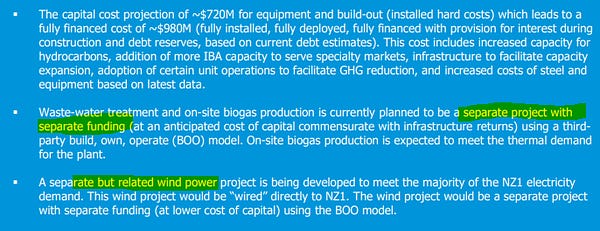

CapEx for the upcoming NetZero project in South Dakota ballooned from $650 mm in May to now being $980 mm. They added some additional capabilities, increasing the run rate revenue projections up $20 mm per year. The assumptions for EBITDA are fuzzy, but it appears that they took advantage of tumbling corn prices and mostly unchanged Jet and RBOB markets to juice the ROI assumptions. Still a 50% increase in capital expenditures is pretty friggin big, which will necessitate a few hundred million in additional debt or dilution. I suspect that’s the main reason the Stock was hit following earnings.

The big, huge, red flag for me was on the call, CEO Patrick Gruber admitted that engineering on NetZero 1 was very fluid and far from completion. He projected a completion time of end of year, but his conviction on this was not exactly solid. The problem is that pushes back construction bigly. I spoke with the Director at the South Dakota Department of National Resources on the phone. They’ve received no information from Gevo regarding this project and no preliminary meeting had been scheduled (both pieces of information are public record). Back of the napkin math has this as a Synthetic Minor or Major source of air emissions, meaning construction cannot even begin until a construction permit is issued, and the time quoted for this is 180 days (at minimum) following the submittal of a complete application to the state. Any EPA review or public comment can tack months on. The company is projecting construction to start in Q1 2022. Folks, that ain’t happening. For a zero revenue company, that additional 1 -2 years added to actually selling your stuff is… hmmm… not great. Covered the highlights on Twitter here:

In May, the "Net Zero" $GEVO facility was projected to cost $650 MM unlevered. It has since risen to... $980 MM levered. Oh and they descoped the project significantly. Total disaster

In May, the "Net Zero" $GEVO facility was projected to cost $650 MM unlevered. It has since risen to... $980 MM levered. Oh and they descoped the project significantly. Total disaster

$GEVO Earnings preview: I know this is a Reddit STONK so caveat emptor Prediction is that they're probably gonna push back projected production from their two facilities. If not today, then soon. 1/

$GEVO Earnings preview: I know this is a Reddit STONK so caveat emptor Prediction is that they're probably gonna push back projected production from their two facilities. If not today, then soon. 1/ ESG Hound @ESGhound

ESG Hound @ESGhoundA nice, tacit admissions on the earnings presentation that their nonsensical farming claims (as outlined by yours truly) aren’t allowed by CARBs LCFS program. This program uses GREET, and yet Gevo claims their modeling of negative carbon fuel are from GREET as well. This remains super deceptive but, you know ¯\_(ツ)_/¯

Lawmaking Updates - Infrastructure Edition

After 5 years and counting, it’s here! INFRASTRUCTURE WEEK, BABY!

I really don’t want this to become an explicitly political publication, but my goodness. What an absolute failure on the part of The Donald regarding infrastructure. Sure seems to me like his fixation on “The Wall” and notoriously short attention span killed any traction we were supposed to have in 2017-2020 on infrastructure. Donald builds things! That was his whole pitch! Tying every proposed spending bill to the pointless, unproductive, monstrosity of concrete and steel that was the border wall was dumb and needlessly political. Oh well, better luck next time, I guess.

Anyways back to the nuts and bolts of the bill, here’s the spending breakdown:

$110 billion for roads and bridges

$39 billion for public transport

$66 billion for passenger and freight rail

$7.5 billion for electric vehicle charging stations

$5 billion for electric and hybrid school buses

$42 billion to reduce congestion at ports and airports

$55 billion for water and wastewater infrastructure

$65 billion to expand broadband access

$21 billion to clean up super sites and cap obsolete gas wells

$73 billion to modernize the national grid and further introduce renewable energy

And my Thoughts:

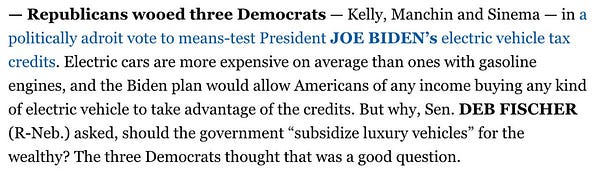

It’s uh, pretty good. Heavy on physical goods and construction, less than anticipated emphasis on things like rooftop solar and EV tax credits, which tend to be gifts to the upwardly mobile and wealthy. Shoot, Senator Deb Fisher (R-NE) even tacked on an amendment to limit this problem. Income limits of $100k and purchase price celling of $40k passes the ESG Hound reasonableness sniff test.

Roads and bridges in the country are in terrible condition, so I get the desire and need to improve them. The externality is that it kicks the can down the road for switching to a more rail based public transit system, but I’m not complaining.

73 billion to modernize the grid is a drop in the bucket of cash needed to add EVs, upgrade transformer and relay tech and stop utilities in places like California from starting forest fires approximately every 3.5 days due to aging and poorly maintained transmission systems.

Speaking of grids, really hoping the federal government takes a howitzer to Texas’ absurd, corrupt, expensive and inefficient grid. ERCOT is like an amalgam of every single over the top negative stereotype about capitalism and government mashed together into a Frankenstein bureaucracy monster from that alternate dimension in Stranger Things. National infrastructure spending may be the way to finally get there, since Governor Abbott is more interested in picking fights over dumb bullshit. I’m a Texan so let me have this rant, ok?

Water and Wastewater and Superfund spending are some great actual ESG uses for government cheddar so I’m very pleased to see them.

Being bearish equities generally seems dumb as heck at this moment in time. If I were allocating capital, I’d be going towards Engineering Plays with big environmental consulting revenues. Looking at you TetraTech (Ticker: TTEK) and AECOM (ACM).

Buy Local! Lots of people, especially retail, will reflexively pile into things like Solar Stocks, especially if the proposed $3.5 trillion add-on spending deal gets approved. Don’t do it. There’s been a huge push on both sides of the aisle to start getting away from buying Chinese products, and the entire US solar manufacturing supply chain relies heavily on China.

If you must invest in renewables, expect wind to get a uh… second wind. Hehe. Vestas Wind Systems (VWDRY) has lots of US manufacturing capabilities and the equity, while on the pricey side, has room to run. It’s a really safe ESG friendly stock to own.

Look at things like asphalt, concrete, steel, water. They’re needed for all infrastructure, green or not.

I’m introducing a new segment, The Infrastructure Corner, this week. We’ll talk unconventional ESG plays, microcaps, and everything else we can. Might even bring on a co-writer to help with this segment. Check out this sweet logo:

BITCOIN!!!!!! - As covered in last week’s roundup, the media narrative around the entire infrastructure bill was a dumb slapfight over regulating bitcoin and crypto exchanges. Then out of nowhere, Senator Shelby (R-AL) OFF THE TOP ROPE! He derailed both amendments by introducing a $50 billion dollar poison pill tied to more military spending. All I have to say to that is: LOL. Naturally, had to update the meme from last week:

Tweets/Blogs/Articles that Caught our Eye

Economic Reality Is Dragging Russia Toward Climate Acceptance - Bloomberg Opinion

Really enjoyed this one. Goes over some of the internal mechanisms and pressures at play in Russia, who still provides all of Europe with the majority of their natural gas. They’re still in *very* early stages, but the ESG investment opportunities in the motherland should be really nice in the coming decade, especially if and when Putin moves on.

Russia still has plenty of political reasons to stick with the dirty stuff, especially if prices hold, and to keep developing Arctic oil and gas. It’s still the world’s largest primary energy exporter and not even the United Nations-backed Intergovernmental Panel on Climate Change report this week pointing toward climate calamity will change that anytime soon. Authoritarian regimes are inflexible and Russia’s elites lean heavily on hydrocarbons. While some corporations have shifted, oil majors like Rosneft Oil Co. PJSC that underpin the Russian polity are still not reckoning with the pace of environmental transformation and fail to look far enough ahead.

But acknowledging the problem is, as they say, the first step, and there are pragmatic moves Moscow can already take.

This is the correct take, but given the political environment over the past few decades I myself remain “purposefully pessimistic” for the time being.

In terms of the green elements of the building: rainwater is stored, reused and then captured in the gardens, heat is drawn from underground geo-thermal wells, and sensors monitor sunlight to automatically lower and raise blinds and switch lights on and off.

All jokes aside, reducing building resource intensity is one program, via LEED certs that’s been doing wonders over the past few decades.

Fried Green Tomatoes - I’m gonna promote another in-house tweet thread, this one on AppHarvest (Ticker:APPH) and the -40% drubbing it took following a disastrous earnings report where management completely lost the plot. Vertically farmed tomatoes that use 80% less water in an economically devastated region sounds like it would be a poster boy for ESG investing as a whole, and in a way it was:

Sometimes, you can get so focused on the plot, you don’t look at the big picture.

ESG Hound TL;DR

VWTR earnings were a snoozer. But, next week, there’s potential for a Tier 1 water shortage to be announced as soon as Monday.

your alpha going into the weekend. For some reason, small and microcap stocks like $VWTR (which haven't been STONKified) will often react to near certain outcomes after the fact, flipping the "buy the rumor sell the news" adage on its headTier 1 shortage declaration, expected Monday (8/16/21) https://t.co/E6Tp3tLwMO

your alpha going into the weekend. For some reason, small and microcap stocks like $VWTR (which haven't been STONKified) will often react to near certain outcomes after the fact, flipping the "buy the rumor sell the news" adage on its headTier 1 shortage declaration, expected Monday (8/16/21) https://t.co/E6Tp3tLwMO lakemeadput_VWTR @LakeMeadPut

lakemeadput_VWTR @LakeMeadPutThis week, an Infrastructure Corner original long! And maybe part 2 of “Bitcoin is Not ESG.” Who knows?

ESG Hound Portfolio

🚀 VWTR - Vidler Water Resources, Inc - Added 7/15/21 - LONG

Price at initiation: $13.10

Current Price: $13.67 (📈 +4.4% for the “fund”)

Move this week: (-2.07%)

💨 GEVO - Gevo, Inc - Added 8/4/21 - SHORT

Price at initiation: $5.60

Current Price: $5.24 (📉 +6.5% for the “fund”)

Move this week: (-10.9%)