Elon Musk has always been the 800-pound gorilla in the ESG room.

Environmental, Societal and Governance investing, despite the recent rhetoric otherwise, is neither Communism nor is it new. ESG was an invention of corporate credit giants like Moody’s and S&P, following scrutiny on mega investors like the massively influential and well-capitalized California Public Employees' Retirement System (CalPERS).

CalPERS had billions of dollars invested in Fossil Fuels, Cigarette companies, and Weapons manufacturers. Headline craving California politicians started demanding that CalPERS reconsider their allocation to such companies. ESG reporting allowed more problematic industries to disclose their impacts and describe improvements they were making to placate concerns. As a result, oil majors have been leading the charge on ESG reporting for well over a decade.

In the early 2010s, sectors like Solar Power and Electric Vehicles had the opposite public perception. These industries took advantage of the institutional “Dumb money” philosophy that equity and bonds from green companies should always be snatched up, regardless of financial reality.

It should be no surprise that no one person benefited from this perception, that “new energy” and “new transport” were the ultimate ESG-friendly investments, more than Elon Musk.

This gold rush was unsurprisingly not without problems. It’s been nearly seven years since the catastrophic collapse of SunEdison, the California-based Solar Giant and one time hottest stock on CNBC. SunEdison executives committed a years-long campaign of fraud and misleading proclamations while personally enriching themselves. This was a calamity of Governance.

Tech companies, such as Facebook, also benefited from conscientious investors. Data centers use lots of power, but on a market cap basis, the carbon impacts were inconsequential in comparison to manufacturers and energy giants. Eventually, people realized that Facebook's core product may have Societal risks. Acting as the primary means for the dissemination of genocidal propaganda in places like Myanmar will wake people up.

Even with such failures, the primary focus of ESG investing has been just the “E.” More specifically, the Environmental sub-component that prioritizes climate change. Environmental stewardship is more than just making cars with a lower carbon footprint. Local water and air pollution are considerable externalities from manufacturers. So too is the impact from input supply chains, from steel to the rare earth and other extractive minerals used to make batteries and motors.

Following a chance online meeting with Ed Niedermeyer in 2016, author of the excellent book “Ludicrous: The Unvarnished Story of Tesla Motors,” I spent a not-insignificant amount of time over the next few years digging through permits and compliance records at Tesla’s California and Nevada factories. This was a personal project that I undertook as primarily a hobby. I helped a few journalists dig into esoteric government records on background; I ultimately took a much-needed break from looking at Musk’s or Tesla’s activities for the next few years.

I started this publication in the middle of 2021. The boredom, malaise, and anxiety as Covid continued into its second horrific year made me want to try something new. “I’ll do that thing I did with Tesla, but with other companies and financial assets,” I told myself. Minimal Elon Musk coverage.

This lasted a few months. I had a ball writing about water rights, biofuels and bitcoins. But Elon Musk has always been the 800-pound ESG gorilla.

When SpaceX, Elon Musk’s rocket company, dropped an application to expand operations in South Texas in September 2021, my jaw hit the floor. The application, signed off on by the Federal Aviation Administration, demonstrated a clear, pervasive, and egregiously bold capture of a regulatory body. I've never seen something so outrageously fraudulent and capricious.

SpaceX claimed that lighting off an experimental rocket, the largest in History, from a postage stamp-sized plot of land surrounded by a wildlife refuge would not be a significant environmental impact above launching commercial rockets that are three times smaller. In addition, SpaceX proposed to build a large oil and gas facility, complete with LNG and a utility-sized power plant, as an afterthought. Documents approving such facilities from other federal agencies would be thousands of pages of data and discussion. SpaceX, with the FAA’s blessing, opted instead for a few hundred words on the topic.

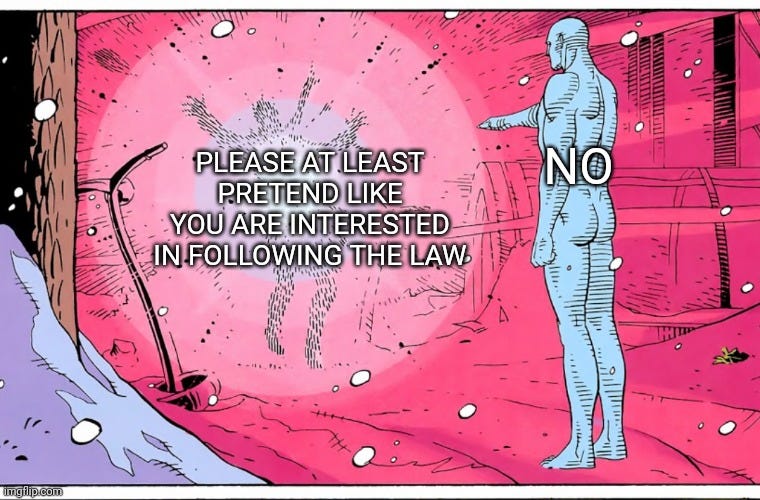

To me, this was an outrageously bold statement by an Elon Musk company; “rules don’t apply to us.” I spent the next few months as one of the only voices in media pointing out the regulatory issues in South Texas. Nearly a quarter-million views on my SpaceX posts later, I’m pleased to note that the natural gas facility I focused on has been completely removed from SpaceX’s plans. But all signs point toward the FAA granting partial approval to perform the test launches in the coming weeks.

As ESG investing grew increasingly popular among fund managers, coverage in the media increased and the topic predictably became a political one. The “ESG is a scam” rhetoric (which, in fairness, correctly points out that it’s often little more than feel-good marketing, something I’ve covered here) intensified in recent months, not from oil executives but from libertarian Silicon Valley icons like Peter Thiel, Marc Andreesen, and Musk himself.

Two weeks ago, S&P unceremoniously pulled Tesla from its ESG index. S&P mentioned the company’s excellent climate reputation, the thing that cemented the company’s reputation as a positive ESG story, as a positive. But, as S&P noted, the company’s atrocious Governance is striking. The company operates at the whims of Musk. Tesla's board in 2016 rubberstamped the purchase of SolarCity; functionally bankrupt and with no credit lifelines, bailing out Musk's personal stake in the solar rooftop installer was the primary motive for the acquisiton. The same board of sycophants and siblings granted Musk an obscene equity package worth tens of billions of dollars. The latest tranch of $23 billion in compensation unlocked last year was more than 2021 annual revenues of $18.5 billion.

Mentioned too by S&P was that the company refuses to look at the carbon impact of their supply chain, has poor internal controls, and continues to get sued for unsafe and racist working conditions at the company’s Fremont factory. This heresy from Standard & Poor's sent Musk and his acolytes into a predictable frenzy. People waking up to the simple reality that the S and G portions of ESG are actually significant wasn’t good enough for Musk and the faithful.

The focus on the societal and Governance portions is a significant development, but let’s be clear here: Tesla has massive environmental problems. The company deliberately and knowingly circumvented air pollution control equipment in Fremont to meet production goals during the Model 3 ramp-up of 2017. This is functionally no different than dumping hazardous waste into a river; an unknown quantity of highly hazardous carcinogens and toxins were released into the community and the inside of the factory over the course of several months. This kind of stuff usually ends up with criminal charges and consent decrees. Instead, the EPA and DOJ settled with the company for mere reporting violations earlier this year.

Racism, sexism, financial shenanigans, and environmental dumping are all ESG problems. So too is the company’s continued insistence on testing experimental self-driving software on public streets, despite regulators and industry experts repeatedly noting that the company is being reckless with lives.

Last week, Insider broke the news that SpaceX paid a former flight attendant $250,000 related to claims that Musk exposed himself to her and offered to pay her for sexual services. Forget the specifics of this “he said she said” case. The fact that company flight attendants, all young and female, are expected to give full-body massages as a company perk to male executives is bananas. Exxon, along with all their megacap peers in the stereotypically misogynist oil business, has forbidden things like expensing trips to strip clubs for decades. In 2022, the idea of such a practice, nude massages on planes, is such an obvious minefield that it’s mind-blowing that the practice wasn’t public knowledge until this month.

If History is any guide, there will be more claims against Musk and the pervasive Bro culture of Musk companies in the coming months.

Musk’s open embrace of the GOP during his circus-like attempt to buy Twitter seems to have put the man on blast from people in the media who until this point were content to ignore his shenanigans. But this isn’t a new phenomenon. In November, Texas Governor Greg Abbott told CNBC that he and Musk talk often and that Musk supports the state's social policies. These policies include the controversial vigilante-enforced abortion ban, criminalizing parents who seek AMA-approved treatment for their transgender children and banning Texas schoolbooks that are too negative about slavery in American History. Musk refused to comment on the claim saying he preferred to stay out of politics.

In the preceding months, Musk did the opposite and got very political, picking fights with democratic senators over taxation and joking that Canadian prime minister Justin Trudeau was Hitler for his management of anti-vaxx rallies in February.

Ted Cruz and Abbott were guests at last month’s GigaAustin’s grand opening. Perhaps that’s why he’s refused to talk about their ghastly management of and response to this week’s massacre of schoolchildren in Uvalde, instead buddying up to Pizzagate truthers on Twitter with rants about Hillary Clinton and accusing the political left in America guilty of spreading the “Woke Mind Virus.”

Musk is finally facing scrutiny to an extent that he never has up to this point. Long-time Musk observers have noted both the change in his personal demeanor and the media's sudden desire to actually fact check the man on his wild claims and pronouncements. Something changed. Musk cozying up to the most controversial segments of the GOP is shocking because he has managed to play up support from both parties beautifully until this point.

There is a lot more to come. Some stories I know about in broad strokes, and others remain whispers for now. Make no mistake, though; Musk knows it’s coming. He said as much.

While the man rants about ESG being a scam, the irony is not lost on people like me who have been knee-deep in ESG reporting and implementation for a decade. The early climate-centered versions of ESG as a philosophy enabled people like Musk to raise tens of billions in fresh capital under the guise of saving the planet. But as ESG matures, that 800-pound gorilla that is Musk can finally be reckoned with. And it likely won’t be on his terms.

"... testing experimental self-driving software on public streets, despite regulators and industry experts repeatedly noting that the company is being reckless with lives. ..."

Some actual statistics would help here. YouTube videos do show FSD to be an outstanding and ever improving product. And Tesla Daily has reported multiple times that Tesla driven cars have fewer accidents and fatalities than other vehicles.