CLICK HERE FOR PART 1: Covers the negative Carbon refining/distilling claims as well as base financials.

This Week: Do we use the F-Word?

I started working on Gevo a few weeks ago. My initial thought was that it was a lot of bluster and over-optimistic projections, to go along with an absurd valuation. Now, having poured through the latest data, I’m starting to really think that the marketing behind the company is deliberately misleading. I believe that their claims are based on unreasonable assumptions and since their investment pitch relies on “Accounting” of GHG impact, this is no less serious than misstated earnings or double booking revenues. Management must give a response. Their claims are based on GREET (A lifecycle analysis software from Argonne National Laboratory) and the math in these projections are absolutely not from GREET factors. They also directly contradict information from many academic publications, which I’ll get into.

So, the question is: “Do we use the F-word yet with these guys?” If we treat GHG models like we do accounting standards, the answer in my view is: “probably.”

Roadmap

In Part 1, I covered the financials and the company generally. They carry an absurd 8-10x valuation premium over established biofuel companies using 5-10 year out revenues. Trailing revenues are basically non-existent. This story is 100% promises on bleeding edge tech and zero or negative Carbon Impact

I also covered how a large part of their “Carbon Negative” claims are using Biogas instead of natural gas, which is a trick to gamify Lifecycle Analysis (LCA) Models. You could do the same thing in Oil refining.

Today, we’re going over farming, and what I found was frankly stunning. Gevo’s claims are predicated on “negative carbon” corn farming, which is something that no one in the scientific community has claimed is even possible. It’s simply not in the literature.* Doesn’t Exist. Not only is the claimed Carbon Impact negative, in some cases it is wildly so. Typically, studies have shown a lower bound in GHG emissions of 50-100 g CO2e/kg of Corn. Gevo appears to claim -200 or lower gCO2e.

*Note, I’m dropping a ton of links at the bottom. I simply cannot find data to support carbon negative corn. See for yourself.

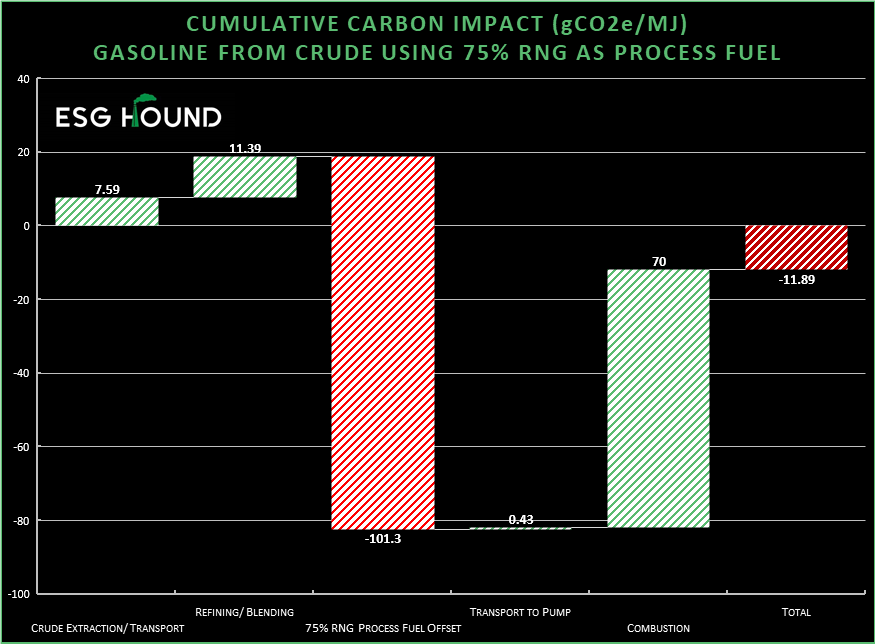

Last week, I discussed how to make a carbon negative fossil fuel hydrocarbon. After a nice email discussion with a member of FinTwit™ I realized there remains some confusion about the individual components of lifecycle analysis using GREET or other techniques. Let’s fix that. I think waterfall charts do the trick beautifully.

Let’s summarize part 1 using this form of charting. The first two charts show the carbon impact in grams CO2 equivalent per megajoule of energy for each step in production of Butanol (substitute for Gevo’s High Octane product)1 and traditional Gasoline products (using GREET):

Now, you’ll notice that fossil fuels make less CO2 during the extraction and refining steps. This is made up for upon combustion. Butanol (and other biofuels) have higher footprints for production. This is because biofuels come from yeast processes. Yeast makes CO2. A lot of it. Just ask any home brewer. These costs are largely fixed because of the cellular mechanisms at play. As such, farming is where the biggest savings are. Along with already discussed tricks like using cow manure biogas (RNG).

The next charts summarize last week’s piece on Gevo, where I used RNG as a substitute for Natural Gas in oil to gasoline refining. Because of how LCA software treats biogas, it makes some crazy (though not scalable and potentially misleading) changes to modeling.

Behold, negative Carbon Gasoline:

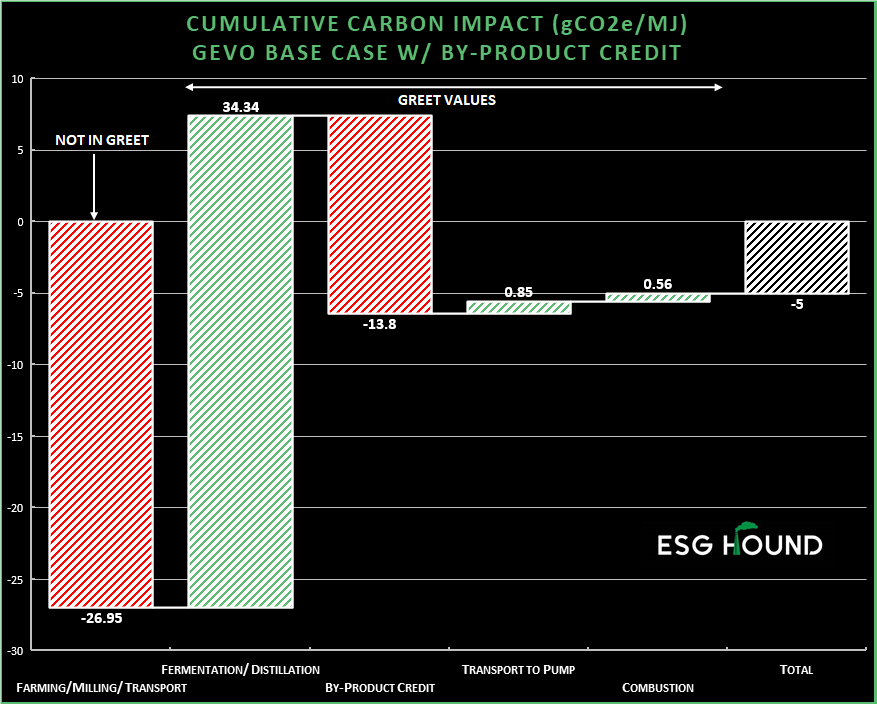

As a reminder from last week, Gevo’s *base* claim is that they will make isooctane and biodiesel that has -5 gCO2e/MJ cradle-to-cradle. And that’s just a starting point, without any RNG offsets.

Using GREET inputs, here is a summary of how to get to -5 (the base case)

We need to find -56.68 gCO2e/MJ to get to that claimed -5 net carbon number. We know it’s not from RNG, and it’s not from the (+34.34) production step. That leaves farming and one other offset from GREET literature.

Per GREET, you can claim up to 13.8 g in offsets per MJ if you make co-products that can be fed to livestock (the dried corn fiber and yeast are a cow feed adjunct). So knowing this, here’s where that leads us:

The implication from Gevo’s slides is that local farming can make up the -26.95 gram/MJ difference. Let’s do some unit conversation back to carbon as a function of grain yield.

Corn -> Isooctane/Isobutane 149,267 btu/bushel corn (dry basis)2

1.055e-4 MJ/btu

21.4 kg corn (dry)/bushel

-26.95 g/MJ * 1.055e-4 MJ/btu * 149267 btu/bu * 21.4 kg/bu = -204.2 gCO2e/kg

That means that Gevo’s corn farming must, as a base case, account for -204.2 gCO2e/kg dry corn. Now look at this chart that summarizes carbon impact of corn production from various studies and models:

The absolute lowest value I could find as even theoretically possible was from a 2020 Study from Poland.3 This +40 gram value was modeled assuming ideal weather, no tilling, advanced sequestration techniques, cover vegetation, essentially no added fertilizer and pretty much every weapon thought currently possible to minimize Carbon Footprint. As I stated before, no current research shows “negative carbon” corn as technically feasible using current techniques, as demonstrated in this 2021 literature review4. Additional data comes from various other publications reviewed by me.5

So where does “carbon negative” corn come from?

I think I found where Gevo is getting its claim. Dr. Jason Sheehan, from the University of Minnesota, completed a Doctoral Thesis regarding carbon intensity using Gevo corn suppliers, as discussed in this Scientific American Article from 2013. The final paper6 gives us a clue.

Each data point in the chart is a farm that supplies corn to Gevo and the associated CO2e emissions. I’ve annotated where all of Gevo’s corn would need to be to meet the calculated base case with the green line. There is one single farm in the study that was calculated as a carbon sink (net -138 g/kg) using farmer completed surveys and a mass balance model; Dr. Sheehan writes:

Obviously, the combination of these three strategies (as seen in farm 6153 in Figure 32) would allow for the greatest reduction in the survey group’s emissions if they were adopted by all of the farms. More importantly, these strategies are not likely to be strictly independent of each other.

The results of the Daycent model prove this out, though we hasten to say that the number of data points available from the survey to evaluate no till practices turned out to be quite small. The conclusions we draw here are thus very preliminary, and will require much more analysis and data collection to improve the precision and accuracy of the findings.

Based on my review of the available literature in this sector, only a single data point from a preliminary survey based study in 2014 shows “negative carbon” corn. That’s not a basis for scaled production, it’s an outlier. It’s preliminary, per the paper’s author! Every Gevo farm must exceed this outlier looking result to meet the company’s claims.

Reminder, this is just for their BASE CASE. Gevo claims they have a credible path to not just -5 gCO2e/MJ fuels, but -150 g/MJ or lower!

Even The Farmland Trust (the Big Ag lobby) Agrees that net zero corn isn’t happening anytime soon. From Their 2020 Carbon Sequestration Update7

Detecting changes in SOC (soil organic carbon) can take many years to decades due to measurement challenges caused by high spatial variability in SOC stocks (Smith, 2004). Furthermore, measurement of GHGs requires expensive equipment and technical expertise, limiting our ability to collect data with the spatial and temporal resolution necessary to inform policies and programs at a national or global scale. Thus, scientists rely on models to predict changes in SOC and GHG emissions under different scenarios to estimate the biophysical capacity of agricultural soils to mitigate climate change and reduce emissions.

(sic)

Estimates of the total mitigation potential from adoption of no-till also vary widely from 68-138 MMT CO2e per year (Eagle et al. 2012, Sperow et al. 2020), largely due to variation in mitigation rates (~0.33-0.60 Tonnes CO2e per acre per year), as these studies assumed similar levels of available land area (~204-232 million acres). Assuming the climate benefits for each practice are additive, combining cover crops and no-till could result in a total CO2e reduction potential of 133-326 MMT annually. This range represents 21.5% to 52% of 2018 U.S. agricultural emissions (EPA, 2020)

An upper bound conceded by the *lobbying* (I can’t emphasize this enough) group is a reduction of roughly 0.9 tons CO2e/acre (or ~220 g/kg) from the baseline of conventional farming (300-500 g/kg). That gets us to about the +40 g/kg level from the Holka study. Indeed a far cry from negative carbon corn.

Here are some links discussing the state of carbon farming:

The Limits of Soil Carbon Sequestration - The Breakthrough Institute

Natural climate solutions for the United States - Science Advances Mag8

To make agriculture more climate-friendly, carbon farming needs clear rules - The Conversation

President Biden, Please Don't Get Into Carbon Farming - Wired

Regenerative Agriculture: Good for Soil Health, but Limited Potential to Mitigate Climate Change - World Resources Institute

The Take-home Message

Gevo management, in short, is making wildly optimistic claims about monoculture carbon sequestration that is not supported by science in Academia, nor by industry lobbying groups with a huge incentive to promote carbon credits. These claims are bootstrapped to a “carbon negative” biofuel, using the widely accepted GREET model as cover. This claim has been used to raise hundreds of millions of dollars from ESG focused investors. The apparent dishonesty is truly brazen.

I think this final chart sums it up well:

To Gevo Management

Show me the data. That’s it. Right now, we are looking at a lot of assumptions that don’t appear to be based on science. This is misleading and sure looks a lot like fraud. The F-word.

You’ve got earnings coming up this week, some clarification would be nice.

I’m available at esg.hound@gmail.com. Let’s chat.

Until next time,

ESG Hound

Disclaimer:

I do not trade individual stocks. I have no position in GEVO, either in common stock, options, grants, bonds, NFTs, lootboxes and have no intention to do so anytime in the future. I was not compensated for this work by any third party. This post is just my viewpoint and is extremely not investing advice.

Su, Yide et al “Biorefinery: The Production of Isobutanol from Biomass Feedstocks” Applied Science (2020)

“Life-Cycle Assessment of Corn-Based Butanol as a Potential Transportation Fuel” Argonne National Laboratory - GREET FACTOR

Holka, M and Bienkowski J “Carbon Footprint and Life-Cycle Costs of Maize Production in Conventional and Non-Inversion Tillage Systems” Agronomy 2020

Scully, M Et al “Carbon intensity of corn ethanol in the United States: state of the science.” Environmental Research Letters 2021

Zhao, Yan et al “Bioethanol from corn stover – Global warming footprint of alternative biotechnologies” School of Environment, Beijing Normal University 2020

Sheehan, John “Scenarios for low carbon corn production” PhD Thesis, University of Minnesota - Institute on the Environment (2014)

Fargione, J et al “Natural climate solutions for the United States” Science Advances 2018